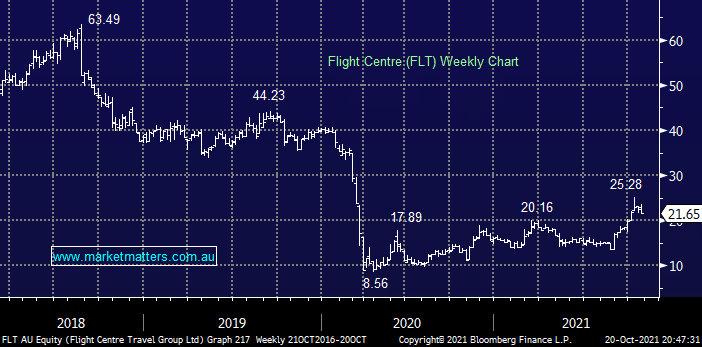

FLT has corrected over 14% since NSW and the countries path to freedom became clear, this pullback feels like a classic case of “buy the rumour sell the fact” as opposed to the market expecting a Round 3 with COVID – however with the UK now registering over 40,000 cases per day we would caution that re-opening may not be as easy as many hope & expect. The recent move is no great surprise but around current levels we’re still 50-50 seeing better opportunities elsewhere. NB: this morning FLT has prices a $400m convertible note with a strike price of $21., Without going into too much detail, the equity hedge has been done at $21 for 3.5m shares and the usual outcome now is a lowering of volatility in the stock.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

MM is neutral FLT

Add To Hit List

Related Q&A

Stock information – KOV please

Preference for CTD over FLT as a “Growth’ stock

CTD in Growth Portfolio versus FLT

What are your preferred travel Stocks: WEB / CTD / FLT?

Thoughts on Flight Centre (FLT) SPP please

What do you think about the FLT SPP

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.