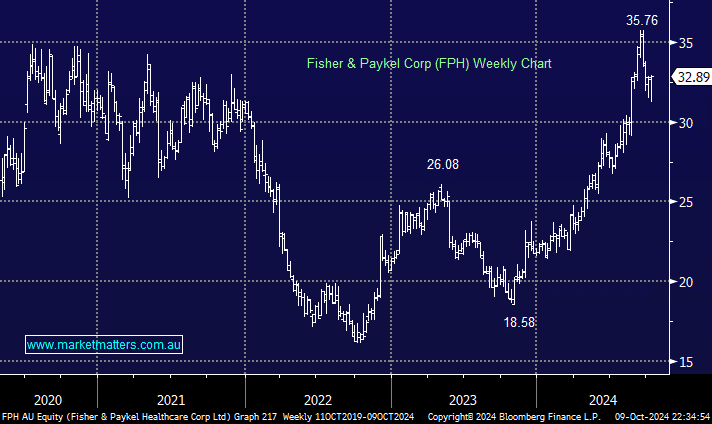

Auckland-based FPH has strong earnings growth, with an impressive 3-year compounded annual growth (CAGR) of 29%. This growth is driven by double-digit revenue growth in Hospitals and Homecare, with margin expansion underpinning the stock’s strong investment case. The company’s superior earnings growth means FPH should maintain a significant valuation (P/E) premium to the region’s large-cap healthcare peers. However, this is starting to look stretched as the stock pushes towards $35.

- We like FPH, but the risk/reward isn’t compelling above $30.