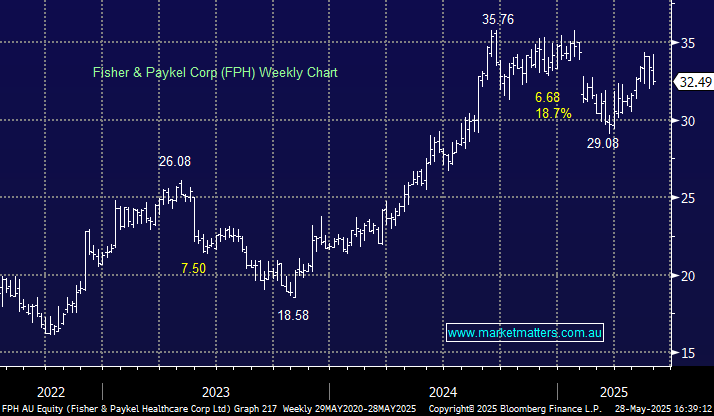

FPH dropped 4.8% on Wednesday, an interesting move for a stock in our Hitlist. The company’s FY25 revenue and profit beat estimates but their FY26 guidance fell a touch short of estimates – a recent story of late with boards remaining cautious as they wait to see the global economic impact from tariffs. FY25 highlighted strong growth across all product segments, along with robust margin expansion. However, markets are currently focusing on guidance, which a few % light on. Forecasted FY26 revenue estimates missed consensus by ~3.6%, resulting in an orderly decline. The stock is trading around fair value, rather than compelling value, but we would expect support to come in if further weakness prevails.

- We like FPH as a business, but the risk/reward isn’t exciting around the $32 area, with tariffs likely posing a challenge to further margin expansion.