What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The weakness across the ASX on Thursday and Friday was severe enough to leave MM questioning our short-term bullish outlook for stocks, but this morning, the local index is set to regain its composure and open up +0.6%. Some US indices tested fresh all-time highs on Friday night, an impressive effort following the hawkish Fed Minutes earlier in the week. Credit markets have largely taken a Fed rate cut off the table for September, while two cuts by January are now considered far from certain, yet equities continue to advance.

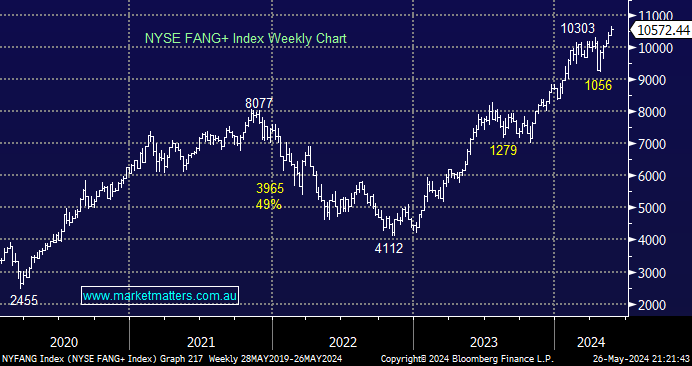

- The S&P500, tech-based NASDAQ 100 index and the US FANG+ Index all closed within 1% of their all-time high on Friday.

- At this stage, we are giving the bull market the benefit of the doubt as our “three steps forward, two back” playbook continues to unfold.

As we often say, a market that can rally on bad news is strong; while this is still the case for US stocks, we believe the air is getting thin, valuations are stretched, and we wouldn’t be aggressively chasing US stocks into their current breakout. Bond markets are likely to dictate terms moving forward, but it must not be discounted how complacent risk assets have become with rate cuts coming later, as opposed to not at all.

- At this stage of the cycle, stocks are likely to remain firm unless the market decides the Fed’s next move is a hike, but we do believe volatility will continue to increase.

- However, as we’ve witnessed in 2023 and 2024, decent pullbacks do unfold within a strong uptrend without changing the market’s overall direction.

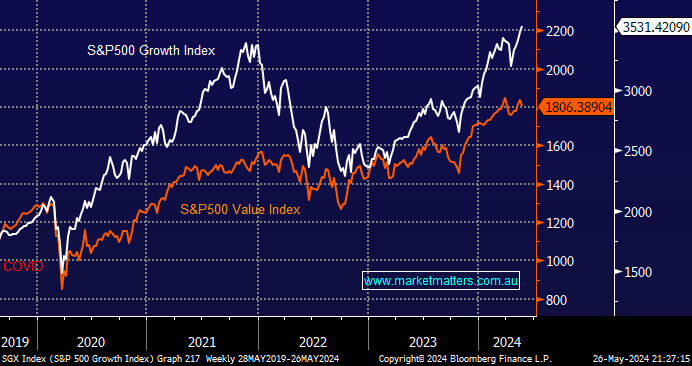

US Growth stocks continue to outperform their poorer value cousins, although both are testing fresh all-time highs. There is no secret behind the growth stocks’ success: it is dominated by the “Magnificent 7”, and while the likes of Microsoft (MSFT US), Alphabet (GOOGL US), and Nvidia (NVDA US) keep making all-time highs, their outperformance will continue. In Australia, we haven’t got such powerhouses, but the ASX200 Tech Sector is still the top performer year-to-date, rallying +25.6% in 2024 compared to the much-lauded Materials Sector, which is down -6.1%, e.g. BHP Group (BHP) -11.45%, Fortescue (FMG) -7.8%, and RIO Tinto (RIO) -2.3%.

- While we expect the ASX miners to play performance catch-up with the tech sector, the current relative performance trend doesn’t look finished just yet.

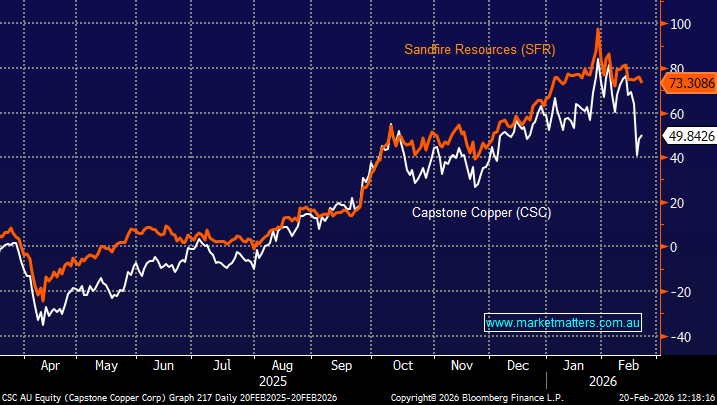

- We’ve seen explosive moves by the likes of copper and gold, but if an investor’s stock selection hasn’t been on point, it’s been a tough sector so far in 2024 – i.e. variance between stocks has been incredibly high.