What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Following recent robust economic data and apparent evidence inflation is becoming increasingly sticky after its steep decline from around 8% in late 2022 to 3.6% today, analysts are split on the future path for interest rates through 2024/5. Most pundits are looking for no change after Tuesday’s 2-day meeting, but the futures market is pricing a good chance of a hike by September – we believe the RBA will adopt a patient stance, but we acknowledge there is now more chance of a hike than there was only a few weeks ago.

- MM believes the next move by the RBA will be a cut, but we cannot see any reason to hurry for Michele Bullock et al.

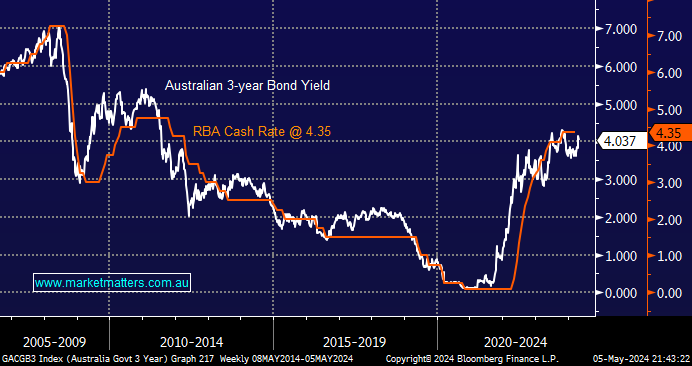

History shows us that the Australian 3-year bonds usually lead the RBA Cash Rate; unfortunately, through 2024, they’ve changed their mind a few times, providing no obvious lead.

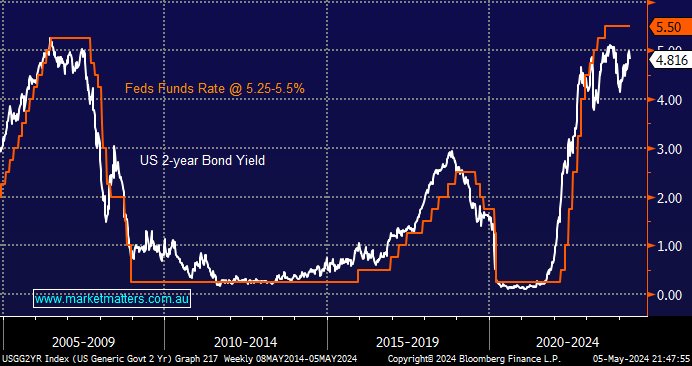

Last week, the Fed left the interest rate unchanged at its targeted 5.25-5.5% band, a 23-year high, as expected. Importantly, they acknowledged, “In recent months, inflation has shown a lack of progress toward our 2% objective.”; hence, with the US economy in good shape, the Fed isn’t in any rush to cut rates.

- The Fed indicated rates would be “higher for longer,” but policymakers believed that the interest rate policy was already “restrictive” enough and that it was “unlikely” that they would raise rates again in this cycle.

- The futures market now prices in two rate cuts by January after Friday’s market-friendly employment data; hence, bond yields remain well under the Fed’s 5.25-5.5% target band.

- US bonds have been attempting to pick the timing of a Fed pivot on rates over the last year, but like our own, they’ve changed their mind a few times.