What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Iron ore has confounded analysts through 2023; the bulk commodity remains strong, having broken above $US130/MT this week despite the gloom surrounding China’s property sector. Interestingly, earlier this month, the IMF returned from a 10-day trip to China and instantly upgraded their growth forecasts for the world’s second-largest economy by 0.4% in 2023 and 2024. The stronger growth in China has kept iron ore well supported, with steel mills not reducing their capacity and simply exporting excess production.

- As iron ore continues to climb a wall of worry, analysts will be forced to upgrade forecasts for the related companies, they could capitulate like dominos after being stubbornly negative through 2023 – this is bullish for the ASX large-cap miners.

Yesterday, we saw BHP climb +1.4% to a fresh 8-month high, and it has been the underperformer compared to RIO and Fortescue, with the latter testing its 2021 all-time high, now only ~4% away. Considering our bullish market stance into 2024, MM’s preferred scenario is BHP will break its January high in the coming few months, currently less than 6% away. However, at this stage, we intend to fade as opposed to chase such an advance.

- We are likely to trim our BHP position if/when the miner tests the $51 area, assuming iron ore hasn’t soared past our $US140-150 target area.

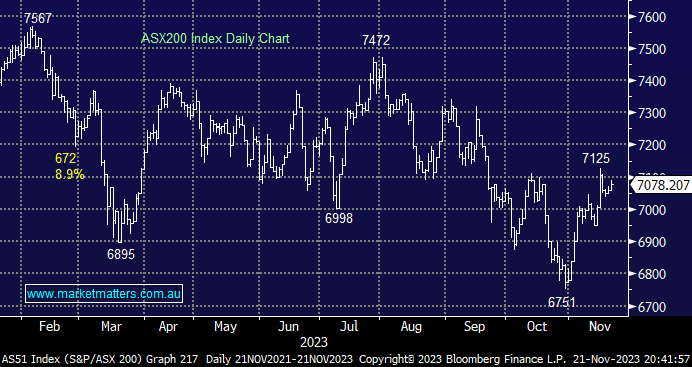

The ASX200 enjoyed a solid Tuesday on the index level, but with less than 55% of the main board rallying, it was left to the influential big banks and miners to perform the heavy lifting, enabling the index to advance +0.3%. The sectors continue to jockey for position with a performance baton into a Christmas Rally potentially at stake. The last week has seen a clear difference on the performance front, with our preferred scenario being more of the same into Christmas:

Winners: Resources, Tech, Real Estate, and Healthcare.

Losers: Energy, Utilities and Consumer Staples.

However, we intend to keep our fingers firmly on the pulse as traditionally, Christmas delivers some decent volatility on the stock level, which often provides some ideal opportunities to tweak our respective portfolios.

- This morning, the SPI Futures are pointing to a small dip of -0.1% on the opening following a muted session on Wall Street.