What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Friday saw markets vote in no uncertain terms that an escalation in the Israel – Hamas conflict was a real possibility, with reports in the local press that Australians were being urged to leave Lebanon, illustrating the increasing concern that the conflict may spread. The subsequent “safety bid” on Friday night was one of the most dramatic we’ve seen post-COVID:

- Gold surged by over $60US/oz while silver closed up by more than +4%.

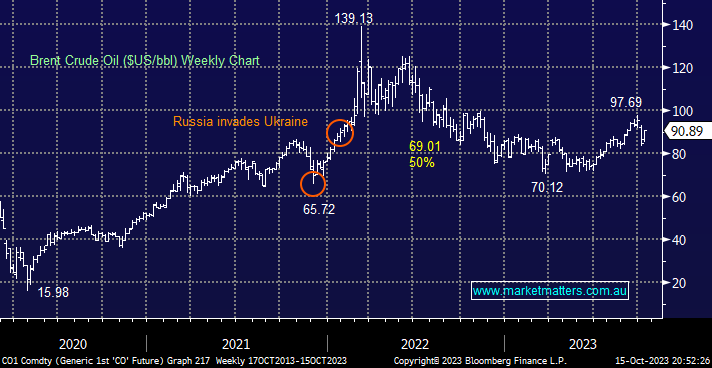

- Crude oil ended the session up +5.7% as supply fears increased.

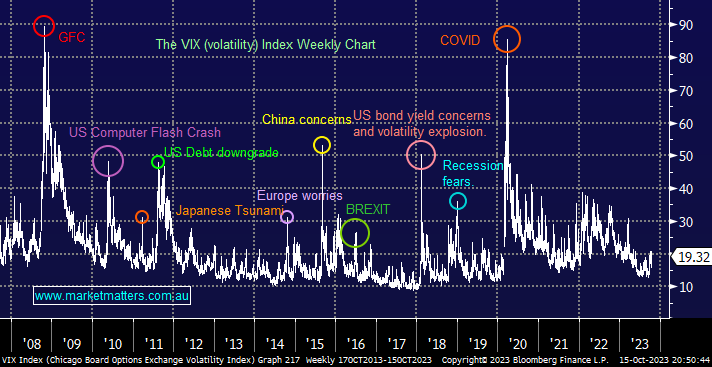

- The Fear Gauge (VIX) popped over +15%, testing the psychological 20 area.

- Bonds enjoyed a bid that saw yields end the week lower, even after the stronger-than-expected inflation data (CPI).

What unfolds between Israel and Hamas over the coming days/weeks is likely to produce ongoing dramatic moves, more than likely in both directions. However, considering the economic and geopolitical headwinds facing stocks, in our opinion, they remain firm, the Dow ended the week and even Friday’s mixed session higher, while the broad-based S&P500 finished on Friday down -0.5% but still positive for the week.

After a few quiet sessions, crude oil soared +5.7% higher on Friday, ending the week with the same concerns as it had opened on Monday. Investors are bracing for the ramifications of the almost inevitable ground assault on Gaza while, at the same time, the White House announced its first sanctions on companies allowing Russia to sell oil above $US60, the level set by the US and its allies – as we mentioned last week the US is “short & caught” crude oil and will be proactive in keeping the price rises in check as they rebuild their reserves.

- At this stage of the conflict, we can see oil testing $US100/bbl., or +10% higher, i.e. back towards levels tested in September.