What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The $US has started edging lower after a strong ~8% bounce from its July low, a move we flagged, but it’s been stronger than we anticipated courtesy of the surge by long-dated US bond yields. A few times this year, we’ve referred to the Greenback as the likely key to financial markets through 2023/4. This has been wrong, with bond yields proving to be the key and the $US becoming one of many markets that have moved like puppets when the bond market has pulled its strings.

Our bullish outlook towards bonds (bearish yields) has been covered at length over recent months, but when we stand back and look at the $US longer term, we believe the market is at a fascinating juncture. Our preferred scenario is the $US reverses lower into Christmas and eventually trades back down towards its post-COVID low, around 15% lower, but a move of that degree could take years and will almost definitely require lower US bond yields.

- We are looking for an eventual break below 2023 lows by the $US, in line with our bearish stance on bond yields.

The influence of a weak $US runs deeply through financial markets, but arguably none more than in precious metals, i.e. when the $US falls, the gold price rallies and vice versa.

- We are bearish on the $US medium term and can see gold well above $US2,000 in the foreseeable future.

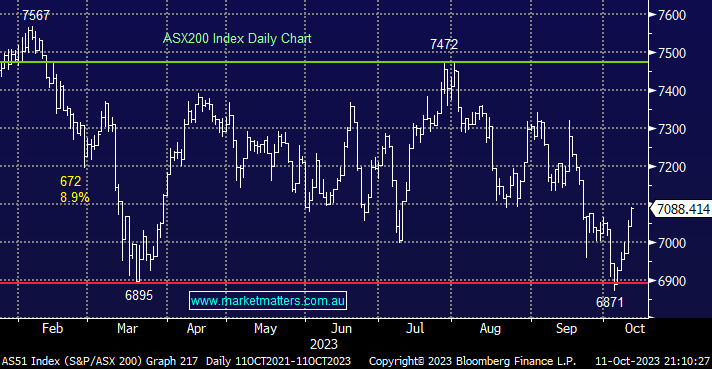

The ASX200 rallied another +0.7% on Wednesday, taking the advance over the last 5-days to +2.9%, a solid start to October following a dismal September. The Tech Sector was the standout, closing up +1.7%, supported by the likes of NEXTDC (NXT) +3.2%, Wisetech (WTC) +2.1%, and Xero (XRO) +1.8% – we remain bullish on the sector, looking for a further 10-15% upside from some of the prominent names. The small losers’ enclosure was dominated by gold stocks, although they only surrendered a small portion of their recent gains.

- We can see the local market re-testing its 7500 resistance area into Christmas, although the main action is likely to remain on the stock/sector level.

This morning, the SPI Futures are calling the ASX200 to open flat after a choppy session on Wall Street, which saw the S&P500 close up +0.4%.

This morning, we quickly updated our outlook on three stocks correlated to the strong Tech Sector as we consider whether all ships will rise as one.