What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

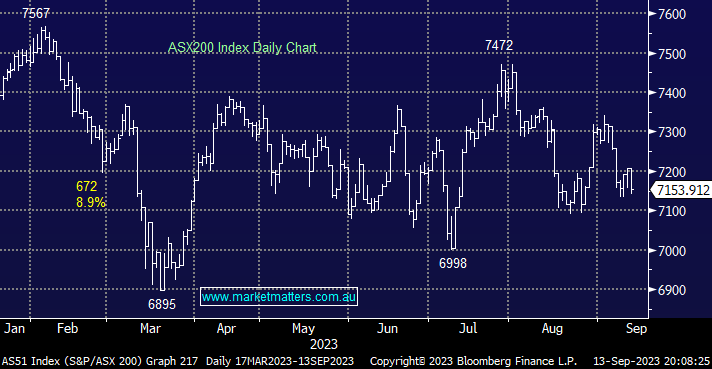

The ASX200 followed US equities lower on Wednesday, ultimately retreating -0.7% with broad-based selling sending over 75% of the main board lower, as we suspected investors weren’t prepared to buck the trend into the much anticipated US inflation data. On the sector front, it was the rate-sensitive Tech and Real Estate Sectors that were the weakest links, while the energy names were again one of the few pockets of strength, albeit ending with a gain of just +0.13% as they failed to emulate the +2.3% advance delivered by the US Energy Sector.

Global equities have been in a holding pattern for the last 24-48 hours ahead of last night’s US inflation read, which most analysts considered vital for determining whether the Fed will hike again in 2023; hence, traders/ investors adopted a cautious approach before the data, especially as the consensus was for headline CPI to come in at 3.6% for the year to August, up from 3.2% a month ago. However, even after mixed inflation numbers, it became a nothing event for equities, with the S&P500 edging up +0.12% – the headline inflation rose for the 2nd consecutive month while core inflation fell for the 5th month in a row, leaving the Fed weighing up two readings.

Energy prices are rapidly becoming the thorn in the Fed’s side in terms of wrestling inflation down, with gasoline prices (+10.6%) accounting for over half of the increase. This morning we’ve revisited the Energy Sector as it exerts a major influence across equity markets on many levels. Overnight, we again saw Brent Crude make fresh 15-month highs with rising demand and OPEC+ supply cuts delivering an ongoing tailwind.

- The SPI Futures are calling the ASX20 to open down less than -0.1% with tech likely to be the shining light.

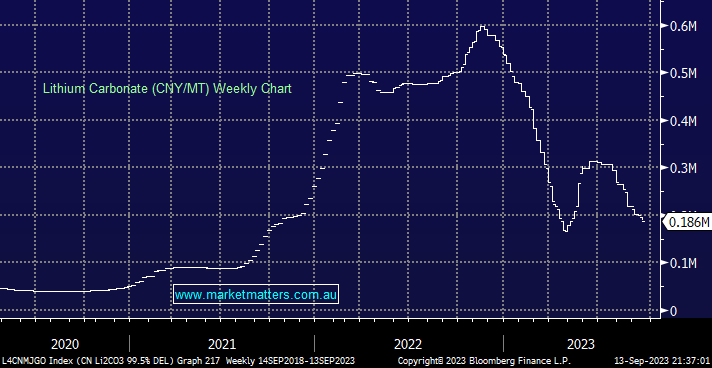

This morning, we’ve quickly looked at three lithium/ESG-facing stocks that endured a tough Wednesday as the underlying lithium price continues to grind lower, i.e. its fallen over -60% so far in 2023.