What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

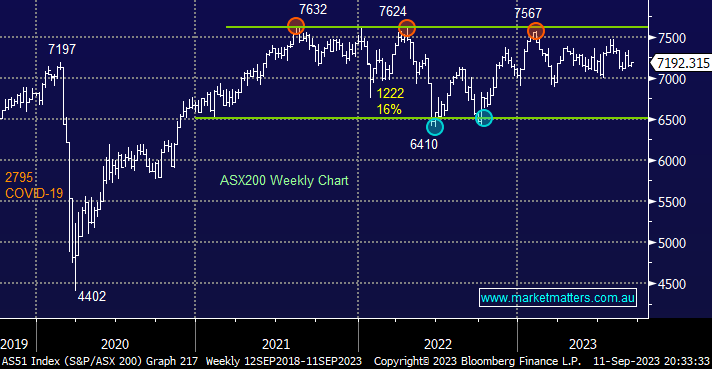

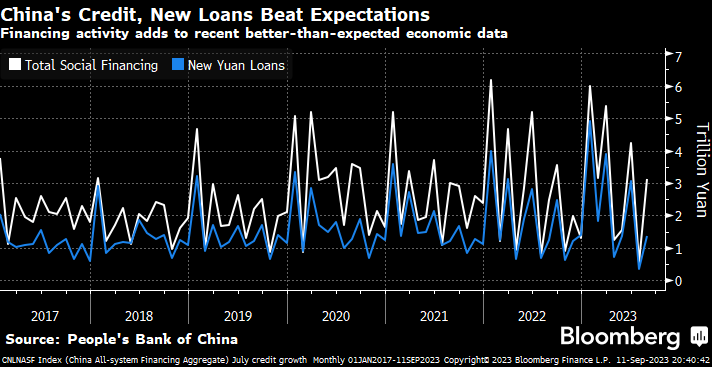

The ASX200 finished up +0.5% on Monday after trading lower into lunchtime before encouraging economic data from China saw buying enter the ASX with the influential resources and financials attracting standout attention. Solid credit numbers suggest recent measures to stimulate the real estate market are starting to gain traction with a pick-up in demand for mortgages and corporate loans. The robust credit data published on Monday added to the encouraging numbers over the weekend, which showed consumer prices back on positive ground for August after posting a negative read in July.

- We remain optimistic that Beijing can steady its troubled economy, with the last few days showing some glimmers of hope.

Financial markets have been hoping for a bazooka-like approach from Beijing. Still, MM believes this would be naïve, especially as we consider the inflation ramifications from such actions being experienced in the West post-COVID. MM is a fan of Beijing’s targeted approach to its economic issues, which are both real and significant, with the last few days suggesting some improvement might be on the cards. If we see follow-through in the improving Chinese data the resources are likely to enjoy a strong run into Christmas, in a similar fashion to Monday’s move.

Over 50% of the ASX200 is made up of the Materials and Financials, both of which shone brightly after the Chinese data trumped expectations, a potentially good read-through into 2024:

- Evolution Mining (EVN) +2.2%, Westpac (WBC) +1.8%, Macquarie Group (MQG) +1.3%, Fortescue Metals (FMG) +1.2%, BHP Group (BHP) +1.1% and Woodside Energy (WDS) +0.7%.

US markets rallied overnight led by big tech, sentiment was helped by Tesla (TSLA US) which surged over +10% after Morgan Stanley said its Dojo supercomputer may boost value by up to $500bn. Economic bellwether copper closed up +2.3% as it embraced the positive news from China which should flow through to further buying in the local miners this morning e.g. BHP Group (BHP) closed up ~30c in the US.

- The ASX200 is poised to open up +0.1% today following gains by the SPI Futures with tech stocks likely to bounce after dipping -0.4% on Monday.

Markets usually form bottoms when things look their worst and China has certainly endured a tough few years but the worlds 2nd largest economy is trying to regain traction in the face of weak consumer sentiment and ongoing property turmoil. Last month’s monthly loans came in at a 14-year low, while the Yuan bounced yesterday after making 16-year lows last week against the $US. We believe there is more stimulus required and on the horizon, but the impatient might become frustrated.

- The Chinese economy is not out of the woods, but the arm wrestle is edging toward Xi Jinping et al.

This morning we’ve again revisited 3 prominent ASX miners as we consider if our positions are on point in the Flagship Growth Portfolio.