What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Wednesday saw bond markets shoot higher (yields lower) at 11.30 am after the CPI inflation print came in at 4.9%, well below the forecast 5.2% although it does remain above the RBA’s targeted 2-3% band it’s trending in the right direction. The impact of this dovish number was supported by weak local building approvals, -8.1% compared to expectations of only a -0.5% drop, plus weaker-than-expected US jobs data on Tuesday night i.e. the ducks are beginning to align for central banks.

Money markets are starting to agree with MM as the probability of further hikes in 2023 has become less than a coin toss as elevated interest rates start to both rein in inflation and slow the economy. We continue to believe that the RBA Cash Rate will remain at 4.1% into 2024, however, we do caution around becoming too optimistic towards rate cuts in the near future as the income RBA Governor Michele Bullock will not want to undo the hard work of the last 15 months.

- We continue to believe local short-dated bond yields will test 3% before 4.5%, a bullish tailwind for stocks.

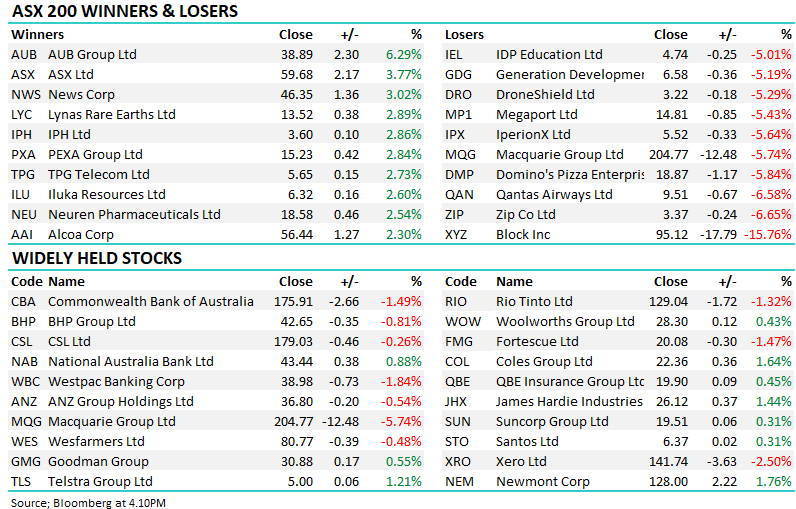

The ASX200 closed up +1.2% yesterday spurred on by the dovish economic data, over 80% of the main board closed higher on the day led by the Industrials and healthcare names. It was hard to find any meaningful weakness in a market that spent a lot of the day up over 100 points and suddenly after three strong days, the local index is only down -1.5% for August, with today’s session remaining, after looking so much worse last week. US stocks have uncannily followed MM’s roadmap through 2023 and if they continue to do so the ASX will enjoy a healthy short-term tailwind.

- The ASX200 is set to open slightly higher this morning following another solid session on Wall Street that saw the S&P500 advance +0.4%.