What Matters Today in Markets: Listen Here each morning

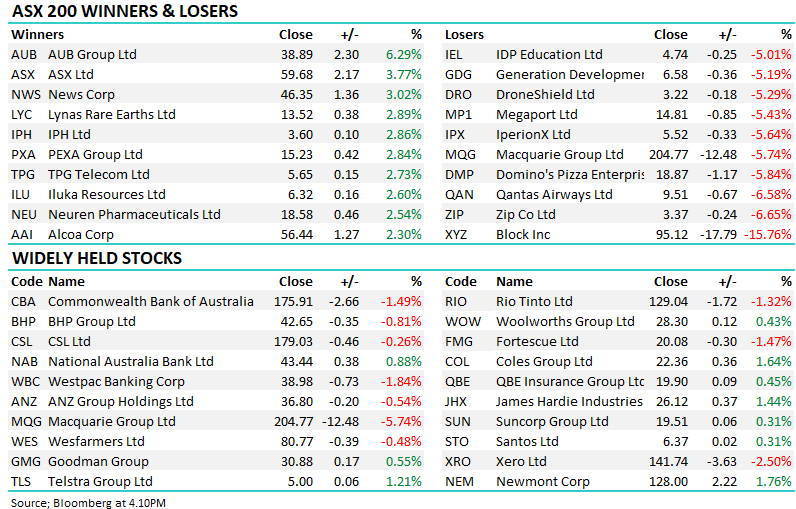

The ASX200 commenced the week with another -0.46% fall taking August’s decline to -4% with another 7 trading days still remaining before we commence September, historically the ASX’s worst performing month over the last 31 years. Tuesday still saw 44% of the ASX200 close positive but when the heavyweight banks and resources, plus CSL for good measure, all close lower it’s always going to create a meaningful headwind on the index level:

Heavyweight Losers: Westpac (WBC) -3.1%, CSL Ltd (CSL) -1.4%, ANZ Bank (ANZ) -1%, RIO Tinto (RIO) -0.8%, and BHP Group (BHP) -0.4%.

Reporting season continues to generate tremendous volatility on both sides of the ledger, the top 3 performers in the ASX200 rallied an average of +9.3% while the equivalent in the losers corner plunged -20%. There has been one very clear trend this month, misses/bad news are not being tolerated with the selling usually following through for many days. However, not all is as bad as it seems/feels as we pass the halfway mark of the current Reporting Season

- Earnings beats are actually outnumbering misses by a ratio of 2:1, illustrating the current underlying strength of the domestic economy.

- However, the coming year is the key with twice as many companies issuing negative guidance as opposed to positive guidance.

Companies are cautioning a slowing outlook for revenue growth, persistent inflation and ongoing labour challenges all dropping down to create an uncertain outlook, hence analysts have continued to revise their expectations lower for FY24 earnings by a ratio of 3:2. At MM we believe many of these downbeat outlooks are likely to prove to be tactical conservatism as management looks to “under promise and over deliver” the problem for stocks is it may take a while for nervous investors to agree with us.

- The ASX200 is poised to open up +0.2% this morning following a solid session on Wall Street where the S&P500 closed +0.6%, a ~30c bounce by BHP in the US should have helped however that will be obsolete following their FY23 results that have just landed (and look a touch light).