What Matters Today in Markets: Listen Here each morning

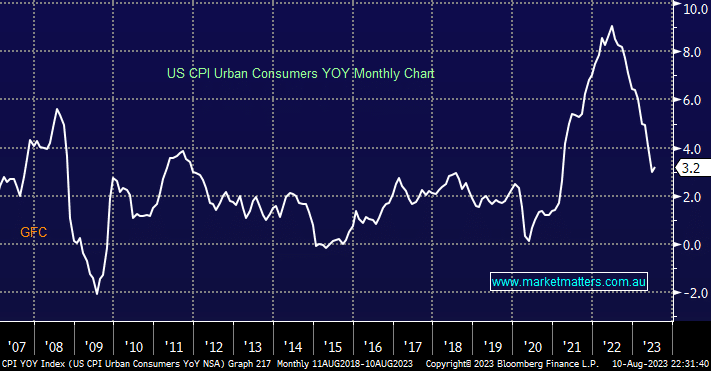

The US CPI for July came in largely as expected with US stocks reacting accordingly, the S&P500 edged up just +0.03%. The CPI surprises on the upside seem to be well and truly in the rearview mirror but investors are conscious that inflation remains well above the Fed’s 2% target. Overnight most of the market’s action unfolded in FX land with the $US hitting a 5-week low against the $US after the Greenback reversed early losses.

- The US Core CPI posted its smallest back-to-back increase in two years.

- Fed Funds Futures are pricing in no hike and then a cut in May 2024.

However, while we believe the Fed are likely to leave rates unchanged at their next meeting the accompanying rhetoric is likely to remain cautious and “data dependant” until we edge closer to 2% – earlier this week Fed Governor Michelle Bowman reiterated her view that the US central bank may need to hike again to restore price stability. Although this week’s tame data was in line with expectations bond yields did edge higher but no more than a usual day’s noise. The balancing act continues between reining in inflation while avoiding a painful recession but so far we believe the Fed is likely to be happy with how things have played out, at least so far, even Fed Chair Jerome Powell acknowledged that rates are nearing a peak.

- Several prominent economists including JP Morgan & Bank of America have scrapped their recession calls this week i.e. calling for the Goldilocks scenario.

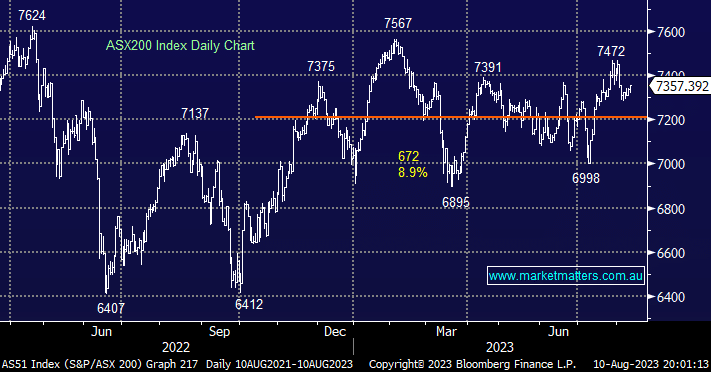

Thursday saw the ASX200 rally strongly through the afternoon to end the session up +0.26%, even a mixed day for earnings couldn’t wake up the bears with the intra-day path of least resistance still feeling like it’s on the upside. Thursday saw some standout sector reversion compared to most of 2023 with the Energy Sector +2.3% the standout winner while the Tech Sector took the wooden spoon and declined -1.8% as some book squaring appeared to unfold ahead of the US CPI. Today will see a quieter day on the reporting front with Newcrest (NCM), REA Group (REA) and Charter Hall Social Infrastructure (CQE) set to deliver their earnings, while Nick Scali (NCK) will also be interesting: Market Matters Reporting Calendar.

- No change, we are holding a relatively high cash position in anticipation of opportunities through the local reporting season.

- The ASX200 is poised to open down -0.3% this morning not helped by a -20c fall by BHP in the US.

This morning we’ve briefly looked at 3 stocks/situations that were discussed at length on the MM desk yesterday, 2 of them might even lead to alerts flashing across your screens over the coming days.