What Matters Today in Markets: Listen Here each morning

Monday was a quiet day at the office courtesy of no major leads from overseas indices following the benign US Jobs Report and NSW Bank Holiday. The ASX200 ultimately closed down -0.2% with winners marginally outstripping losers but the influential major banks and miners found themselves on the wrong side of the ledger weighing on the index. Although it’s not prudent to read too much into extremely quiet days a few points caught our attention as certain pockets of the market appeared to experience a dearth of sellers:

- all of the Discretionary Retailers closed higher led by Super Retail Group (SUL) +2.05%.

- the travel & tourism stocks were strong with Flight Centre closing up +1.13%.

- the interest rate-sensitive Real Estate Sector was solid led by National Storage (NSR) +1.36%.

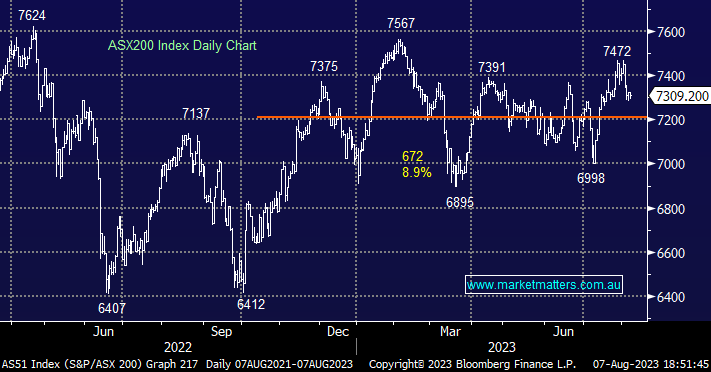

While one day certainly doesn’t make a summer we believe the market is placing some bets that we are going to enjoy the “Goldilocks Scenario” where central banks rein in inflation without sending the global economy into a recession. The combination of steady employment data and declining inflation has MM believing this market-friendly scenario definitely shouldn’t be discounted – MM’s core macro view is bond yields trade lower into 2024 hence if this view proves on point our main question is on whether Australia can avoid a recession. While we continue to look for a pullback/period of consolidation by equities our focus remains on what stocks/sectors we want to own as another macro-economic chapter starts to unfold.

- The ASX200 is poised to open up +0.4% this morning following a bounce on Wall Street following the 4-day slide last week as the important inflation report approaches on Thursday.