What Matters Today in Markets: Listen Here each morning

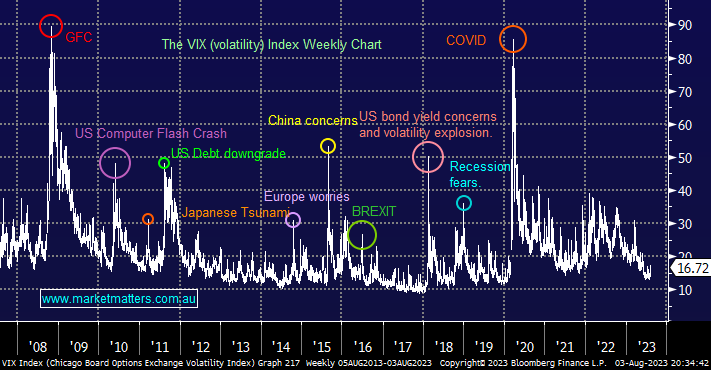

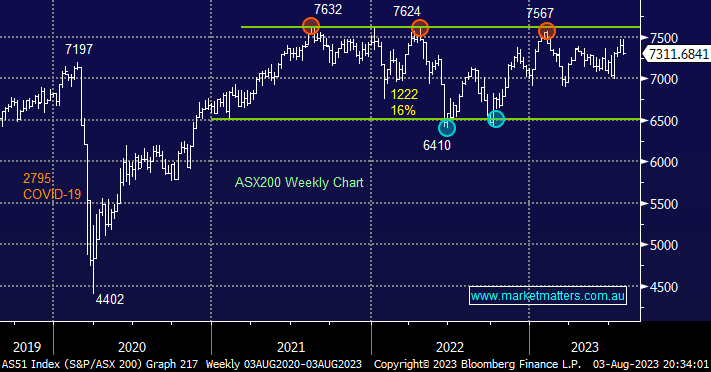

Volatility is back in town which sounds like an old rock classic from the 1970s. The VIX Index has already surged more than 30% this week but when we look back at what happened back in 2011 when S&P downgraded US debt the current move hardly registers – we believe people were long and optimistic when the index was nudging 5000 more than a decade ago but this time when we’re trading well above 7000 there are plenty of bears around due to a very uncertain economic backdrop:

- We believe the current US debt downgrade may take stocks down into next week but the move is unlikely to represent the carnage of 2011 since margin lending is almost dead and people have been nervous toward stocks for months i.e. this is often called the most unloved bull market in history.

- However we are conscious of the “crowded trade” position that’s built up in the Tech Sector through 2023, this is where we could see some standout profit taking which would in all likelihood eventually present opportunities.

Outside of equities, bond markets and currencies have experienced more muted reactions to the debt downgrade by S&P, both yields & the $US have edged higher but the US 2-Years Yield is still well below last week’s high although long-term yields have made multi-month highs ahead of tonight’s US Jobs Report i.e. a clearer picture will unfold next week. Our best guess is there’s more fun and games likely to unfold over the coming 1-2 weeks but unless we see aggressive moves flow over into bonds and currencies MM won’t be too concerned. Equities slipped for a 3rd consecutive day overnight but they still haven’t endured a 5% pullback since March. The VIX is trading around its highest level in 3 months but still at relatively low levels:

- When we consider our outlook towards global equities we believe it’s unlikely the VIX will push much above the psychological 20 area.

- However, we are conscious that if it does we could see some rapid de-risking across equities as computer-based models tend to run from climbing volatility.

Thursday saw the ASX200 tumble another -0.6%, when you stare at the tape too closely it feels like stocks are enduring a meaningful correction but the local index is still holding around last week’s lows, at least for now. Yesterday’s losses were fairly broad-based with less than 25% of the market eking out gains but on the sector level, the Tech stocks were worst on the ground falling -1.6% but there was little on offer to cheer for the bulls with the banks and heavyweight miners weighing on the index.

- No change, we are holding a reasonable cash position in anticipation of opportunities through the local reporting season.

- The ASX200 is poised to open marginally lower following a volatile session on Wall Street which ultimately closed a touch lower but above its intra-day lows.

This morning we’ve briefly looked at 3 stocks that caught our attention in the loser’s enclosure yesterday as we scan the boards for buying opportunities over the coming weeks.