What Matters Today in Markets: Listen Here each morning

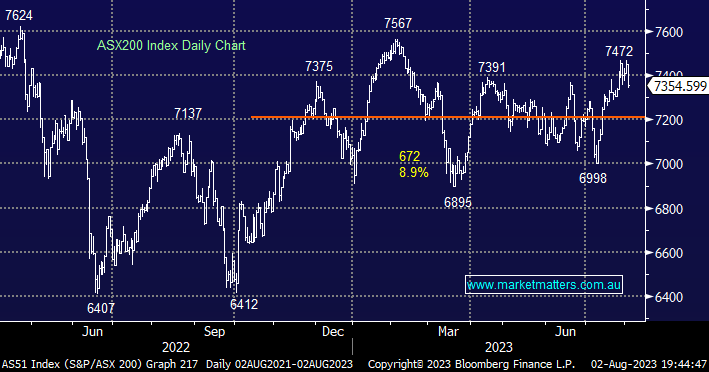

A “rich” market doesn’t digest bad news overly well and that was certainly apparent yesterday when a pretty innocuous and arguably outright weird downgrade of US credit from AAA to AA+ by Fitch wobbled global equities e.g. The ASX200 fell -1.3%, Japan’s Nikkei -2.3%, the Hang Seng -2.5% while during their overnight trading, the US S&P500 futures fell up to -1%. Fitch, one of 3 independent agencies that assess credit said it had noted a steady deterioration of US governance over the last 20 years, Janet Yellen who we hold in high regard called the downgrade “arbitrary” and based on outdated data from the 2018-2022 period.

- We cannot see a clear catalyst for Fitch to press the button yesterday – US debt/risk of default has been escalating for years, perhaps they wanted to get in first before we actually get a US debt default when another pantomime-style last-minute compromise fails!

Unlike many prominent names, we can understand some of the reasoning behind their action but the timing does seem strange as the Fed starts to rein in inflation while the economy remains on a solid footing i.e. the “Goldilocks Scenario”. We believe it would have been far more logical to wait to see if the Fed can indeed engineer a soft landing through 2024 with Goldmans echoing our thoughts – “The downgrade mainly reflects governance and medium-term fiscal challenges, but does not reflect new fiscal information”.

- After the initial knee-jerk reaction, we believe the move by Fitch will be largely discounted by financial markets.

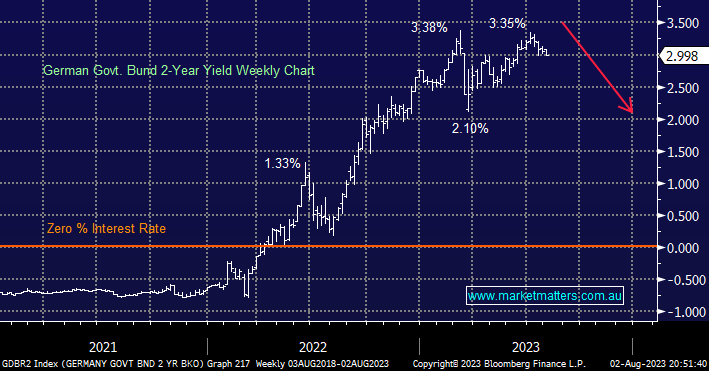

Interestingly unlike equities global bond markets hardly reacted to the news, this comes as no major surprise to us as we’ve been looking for a pullback/period of consolidation by stocks after a stellar start to 2023 spearheaded by huge gains by the “Magnificent Seven” i.e. 80% of the gains by the US Market has come from Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla.

The ASX200 tumbled -1.3% on Thursday with losses increasing through the days on increasing concerns around how US stocks would react to the left-field move by Fitch. Losses were broad-based with over 85% of the main board falling, and most noticeable in the Financial, Utilities & Real Estate Sectors but the best performing group was Tech and they still fell -0.45%.

- We have been looking for a period of consolidation/pullback by global equities, this may have been triggered by Fitch.

- The ASX200 is poised to open down another -0.8% this morning following losses on Wall Street.

This morning we’ve briefly looked at 3 stocks that caught our attention yesterday with all of them rallying on what was largely a weak day for equities: