What Matters Today in Markets: Listen Here each morning

Xi Jinping’s pledge to revive growth is gaining traction even though the latest promises from the Politburo were very skinny on detail/specifics. The sceptics will point to the previous busts of optimism failing to follow through and stocks eventually slipping lower but we believe the tone is the key to the latest rhetoric plus the recognition of the challenges that lie ahead which combine to be bullish in our opinion. Tuesday saw the Hang Seng rally +4.2% while overseas investors purchased a net $US2.7bn worth of mainland Chinese stock, the largest daily inflow since December 2021.

- We believe that Beijing has drawn its proverbial line in the sand which is great news for stocks and especially the resources i.e. the worm has turned.

Gains were widespread across China-linked markets with gains from tech to retail but the standout was the property-facing stocks i.e. a Bloomberg basket of property names gained +10%. Many of Beijing’s comments were focused on property, which directly & indirectly accounts for up to 20% of China’s GDP, and they were all bullish in our opinion:

- Property Sector bonds rallied as Beijing pledged an “adjustment” of restrictions which theoretically will help liquidity & demand i.e. a great example of almost zero detail.

- The Politburo even omitted Xi’s catchphrase “houses are for living, not for speculation” i.e. they don’t want the housing market to fall any further.

We may have heard similar noises before but just like people often quote “Don’t fight the Fed” we believe it’s time to acknowledge this same with regard to Beijing – a great read-through on the Australian Resources Sector. Similar to the cyclical commodities and miners the Hang Seng is arguably a market often best approached from an active perspective and after more than halving from its 2021 high a decent bounce fuelled by some Beijing stimulus feels like a very realistic possibility.

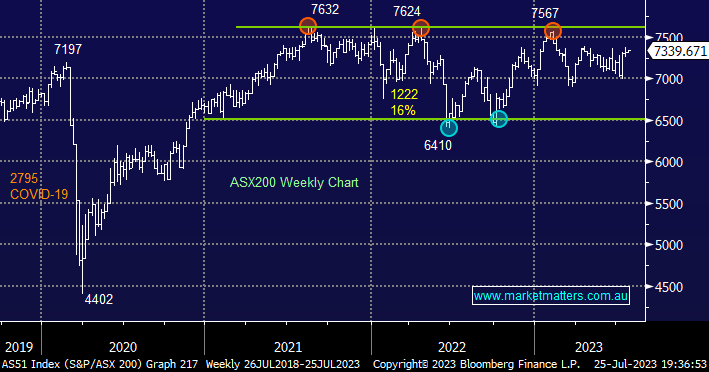

The ASX200 rallied almost +0.5% yesterday managing to shrug more than half of the main board closing lower on the day because the heavyweight miners roared back to life spearheaded by the likes of BHP, RIO and Fortescue all of which closed up well over +3%. If our view towards China proves correct the ASX is extremely well-positioned to shine compared to its global peers into Christmas and beyond – there’s certainly plenty of room for the miners to play catch up compared to the Tech Sectors’ stellar year to date e.g. BHP’s up less than 1% in 2023 compared to Xero (XRO) whose soared over +70% higher.

- We believe the comments from China yesterday will prove to be the catalyst which fuels the miner’s outperformance through the 2H.

- The SPI Futures are pointing to open up around +0.25% this morning with BHP up ~$1.50 in the US set to offer another helping hand to the index.