What Matters Today in Markets: Listen Here each morning

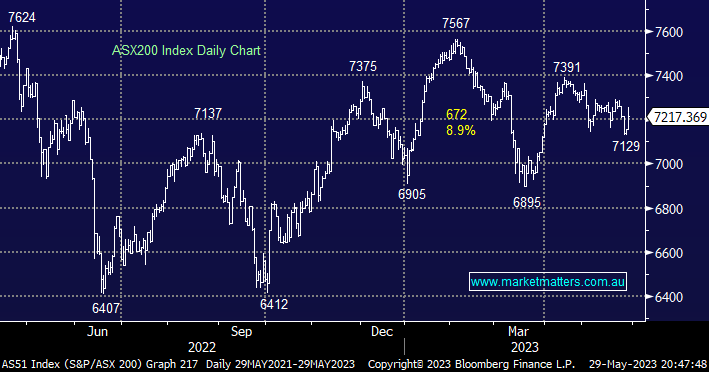

The ASX200 opened strongly as expected on Monday trading up 100 points early in the session before surrendering all of the implied gains courtesy of the US debt deal i.e. The SPI futures closed below where they did on Saturday morning before the positive announcement by Biden & McCarthy. While the +0.9% advance was solid and broad-based with over 70% of the main board closing up on the day the sellers again weren’t shy to take some money off the table intro strength however, the Real Estate and Financial Sectors remained strong throughout the day closing up +1.9% and +1.2% respectively, more on the former later today.

- The US debt deal is good news for markets but it remains a worry that the world’s largest economy would have run out of money in a couple of weeks aka an “undisciplined college kid”.

Unfortunately as is so often the case this is a 2 headed coin as once Congress gives the debt deal the tick of approval we may see the sugar hit fade away as the US Treasury issues bonds to avoid the default which Janet Yellen confirmed was just around the corner. This US bond issuance will theoretically reduce market liquidity and push up short-term rates which creates headwinds for risk assets e.g. the cost of capital will rise for businesses as they compete for cash with the theoretically “safe” Treasury. However, it is important to remember that markets usually move ahead of the fundamentals:

- US 2-year yields have already risen almost 1% over the last 4 weeks as money markets priced in a successful debt deal and subsequent issuance of bonds by the US Treasury i.e. its arguably already old news.

The local index continues to feel “tired” around the 7200 area, especially compared to the S&P500 which has rallied strongly since mid-March. As we keep saying 2023/4 will be all about stock & sector rotation as opposed to picking the future direction of the underlying index e.g. so far in 2023 the ASX Tech Index has rallied +26% while the Financials & Energy Indices are struggling in negative territory.

This morning the SPI Futures are pointing to a small fall by the ASX200 following the limited lead from overseas indices with US markets closed for Memorial Day.