What Matters Today in Markets: Listen Here each morning

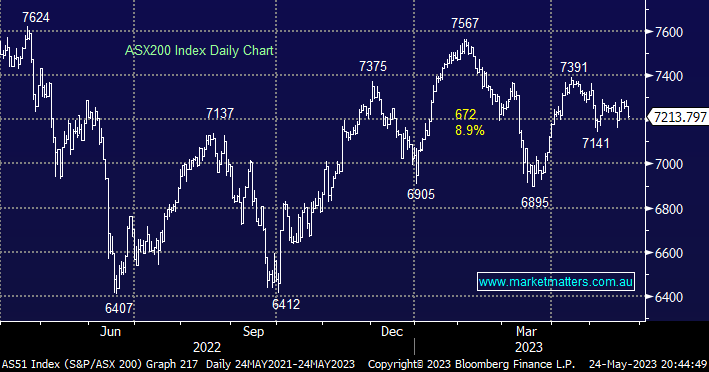

The ASX200 compounded Monday’s poor afternoon falling another -0.63% yesterday as fears of a US debt default intensified as the standoff between Biden and McCarthy showed no signs of improvement – as we’ve said before let’s hope politicians put egos aside and find some middle ground for the sake of everyday Americans. Over recent weeks, we have been asked questions similar to, “What will happen if the impasse continues with the debt ceiling talks and the US cannot meet its financial obligations?”. The answer is we aren’t exactly sure but it’s unlikely to be pretty:

- The White House estimates that a prolonged default could lead to over 8 million job losses and a global recession but a brief default could lead to 500k job losses.

- Moody’s Analytics has estimated that a default of up to 1-week would lead to the loss of 1.5 million jobs.

The House Republicans are refusing to raise the debt limit unless Biden and the Democrats reduce federal spending both now and in the future whereas Biden is insisting on approving the debt ceiling without restrictions as “the US has always paid its bills and defaulting is non-negotiable” but even as President, he’s not driving this train without the support of McCarthy. Biden wants to increase taxes on the wealthiest Americans and several big companies, but McCarthy has said that is out of the question, similar views that the respective parties have expounded over the decades:

- The Treasury says it will run out of money around June 1st but once Biden & McCarthy agree it then needs to pass a vote in the Senate i.e. the clock is ticking!

A government default would dramatically push up the cost of US debt and would be a major headwind to both the US and the global economy, while as an aside it would make Trump look good just as election fever starts to pick up. While there are a few emergency levers Biden could pull if an agreement isn’t reached the impact on equities is our focus at MM, we intend to look closely at some resource stocks later in today’s report but we see 3 possible scenarios unfolding in the next 1-2 weeks:

- Biden and McCarthy reach an 11th-hour agreement that would be supportive of stocks short term – we allocate an 80% probability of this outcome, and MM would be looking to sell into any euphoric moves.

- The game of chicken isn’t resolved and we witness a short-term default – we are allocating a 19% probability of this outcome, and MM would be looking to accumulate recession-sensitive stocks into panic selling i.e. our optimum scenario to adding value.

- We see an unprecedented major US debt default – we are allocating a 1% probability of this outcome, and MM would be looking to accumulate recession-sensitive stocks into early panic selling but this would be reversed and losses incurred if the US implodes. i.e. it would take time for option 2 to turn into option 3 – but if this happened, we would reduce market exposure, no doubt taking losses in the process.

This morning the SPI Futures are calling for the ASX200 to open down another -0.5% after a tough night on Wall Street where the broad market fell -0.7%. BHP Group (BHP) closed down 50c in the US where the Energy Sector was again the only area that managed to close in positive territory.