What Matters Today in Markets: Listen Here each morning

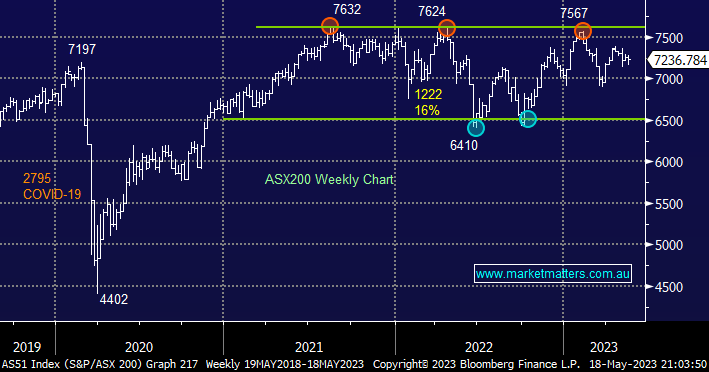

The ASX200 rallied over +0.5% on Thursday although again we saw some selling into strength with the market relinquishing ~40% of its early morning gains. Under the hood, we saw over 60% of the market advance with Tech names continuing their march higher, this time helped by the bullish sentiment following a positive earnings report from Xero (XRO) which ultimately closed +8.9% higher, the “tech v Miners” elastic band which MM has been discussing at length recently continues to stretch ever higher:

- Tech stocks year to date: Xero (XRO) +43%, WiseTech (WTC) +41%, NEXTDC (NXT) +32%, REA Group (REA) +25%, and SEEK (SEK) +15%.

- Resources stocks year to date: Whitehaven Coal (WHC) -26%, RIO Tinto (RIO) -5%, Alumina (AWC) -5%, Woodside Energy (WDS) -4%, Mineral Resources (MIN) -3%, and BHP Group (BHP) -3%.

MM went aggressively long tech back in Q4 of 2022 primarily because we felt markets had become far too bearish towards bonds i.e. lower bonds equates to rising yields. This roadmap has played out perfectly to date but we caution that our belief is the “easy money” is well and truly in the rear-view mirror.

- Coming into last Christmas Australian 3-year bonds were testing 3.75% while the RBA Cash Rate was still under 3% as we started December.

- This week the same 3-year bonds are bouncing back above 3%, after testing 2.75%, yet the RBA Cash Rate is at 3.85% with Philip Lowe et al still threatening further hikes to restrain inflation.

We believe that from a risk/reward standpoint, bonds have swung from being too cheap to potentially too expensive. Investors are already pricing in a rate pivot by central banks before interest rates fall in 2024, from our perspective investors’ current positioning leaves plenty of room for disappointment i.e. if we followed the adage of “buy on rumour & sell on fact” we would be looking to sell tech/growth stocks when we see the likes of the FED &/or RBA signal they don’t expect to hike rates further – also remember the Bank of Americas recent survey flagged long “US Big Tech” as the standout most crowded trade.

Yesterday MM dipped our toe back into the Resources Sector by allocating 3% back into Sandfire Resources (SFR) under $6, importantly we’re not saying the elastic band is about to snap just that it’s time to start repositioning for the potential risks if central banks don’t please all of the doves awaiting central bank pivots etc

- No change, we are sticking to our “buy weakness and sell strength” mantra for 2023 as sector/stock rotation continues to dominate the market e.g. buying SFR.

This morning the SPI Futures are calling the ASX200 to open back around 7250 with the abovementioned theme likely to continue i.e. the NASDAQ rallied +1.8% while BHP Group (BHP) edged down -10c.

This morning we’ve quickly looked at 3 stocks/spreads that caught our attention yesterday as the action on the stock/sector level gets increasingly interesting: