What Matters Today in Markets: Listen Here each morning

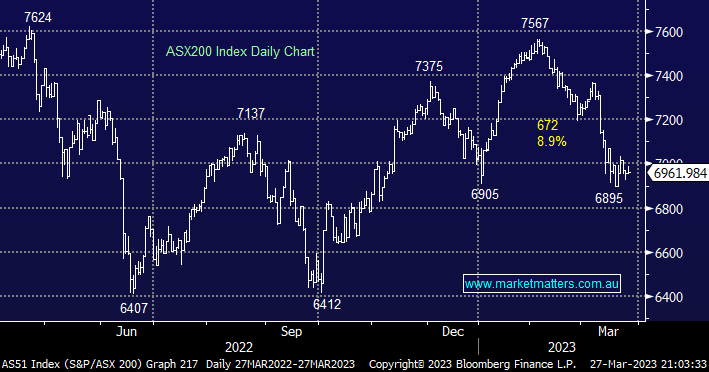

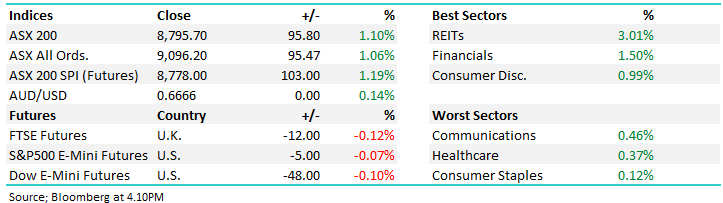

The ASX200 enjoyed a rare quiet day on Monday with the index finally closing up just +0.1%, over 60% of the main board stocks rallied but the banks slipping into the close was enough to limit the advance on the day. The “risk off” theme was again evident as the Energy Sector struggled while the healthcare stocks enjoyed a strong bid across the sector. In line with the significant pullback in global bond yields, we again saw investors nibbling away at our growth stocks but without the conviction being enjoyed by US names i.e. over the last fortnight the NASDAQ has bounced +10.7% whereas the ASX Tech Sector has struggled to make any positive headway.

The lithium names endured another poor day as they fell largely in sympathy with Lake Resources which we will cover later, heavyweight Pilbara closed down over -3% taking it down -8.3% since January 1st and over 40% from its October’22 high – MM believes the ESG space is alive and well but as we flagged over recent months when positions/ views become too crowded the washout can rapidly become deep and painful with such pullbacks often falling further than many thought likely.

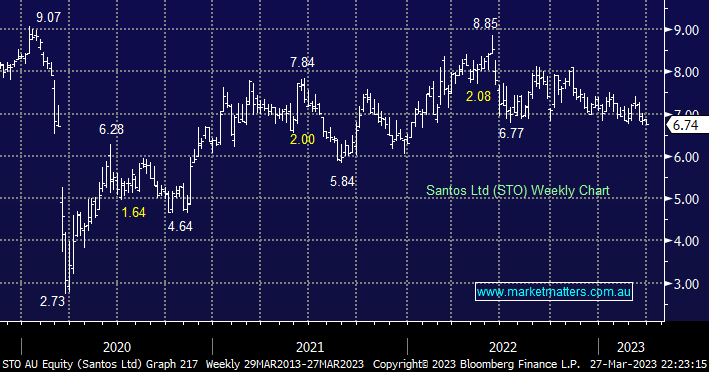

Gas stocks now appear to be the major loser of the Greens’ backing of Labors carbon plan, one of the cornerstones of Labors policy is to cut annual emissions from the country’s 215 biggest resources, manufacturing, and industrial polluters – I doubt if anybody has issues with this assuming its implemented sensibly and we don’t waste billions of dollars chasing unfeasible ESG ideals. We don’t believe the news was a major surprise to investors as the mild -3.35% drop in Woodside (WDS) and -1.65% in Santos (STO) would suggest.

- However we see no reason to increase our 3% exposure to oil and gas in WDS unless we see a dip under $30.

- Overnight we saw a +4.4% bounce in crude which translated to a +2.1% bounce by the US Energy Sector, it will be interesting to see if local names can embrace this move.

US stocks advanced overnight as a relief rally in financial stocks lifted the market and overall sentiment although the subsequent fall in bonds (yields higher) and $US25/Oz drop in gold will weigh on some pockets of the market e.g. the NASDAQ slipped -0.70%. Gains extended through the afternoon with the Financial Sector closing up a healthy +1.4% while the energy stocks led the gains following the sharp bounce in oil, US Treasuries rallied back above 4% as calm returned to financial markets.

- Regional lenders recovered ~3% with First Citizens Bancshares Inc rallying over 50% (yes fifty!) after agreeing to buy embattled Silicon Valley Bank.

Following the S&P500’s +0.2% rally the SPI Futures are pointing to a 30-point gain by the ASX200 this morning helped by a 35c improvement by BHP in the US and a likely strong session for our influential banks.

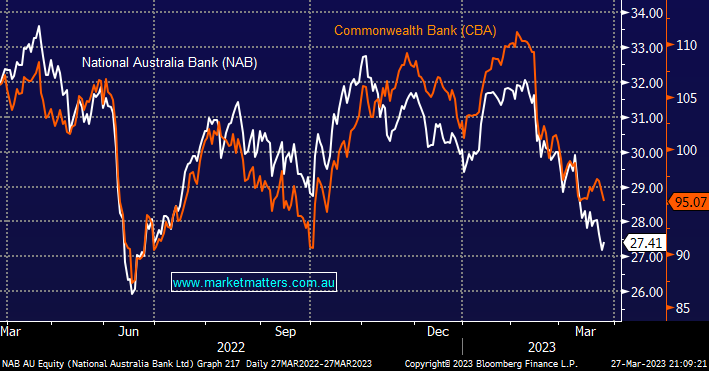

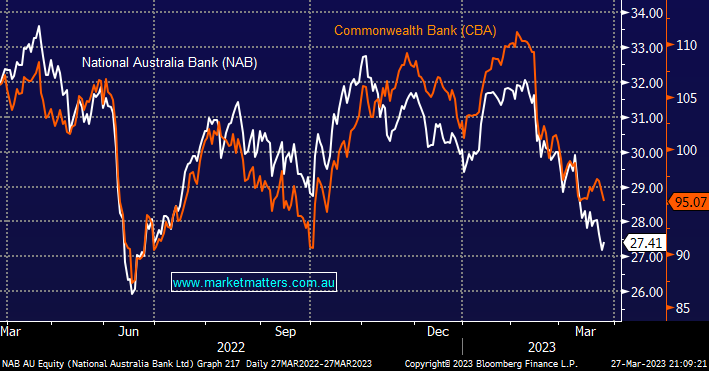

Yesterday saw investors take on board a little more risk within the Banking Sector with NAB rallying +0.85% while CBA slipped -0.9% but as the following chart illustrates both banks have been neck and neck in a race to the bottom from their early February high. We’ve been saying for a few weeks that CBA could test the $90 region during the current anti-bank environment and at this stage, we see no reason to change this stance.

NB CBA traded ex-dividend $2.10 fully franked on the 22nd of February which skews the picture slightly.

- We can see the banks in general slipping another 5% over the coming months hence we remain comfortable with our underweight stance.