What Matters Today in Markets: Listen Here each morning

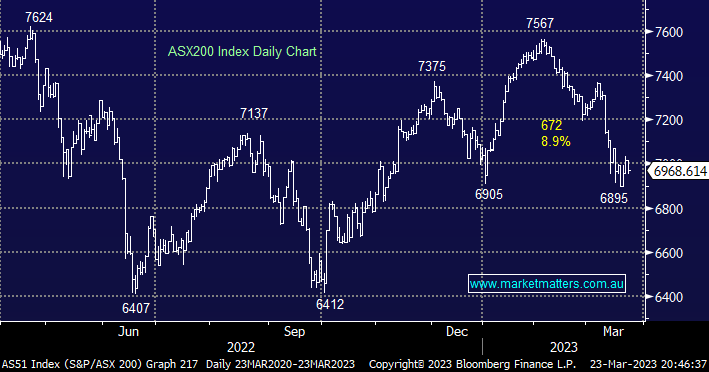

The ASX200 fell on the penultimate day of the week following the confusing & contradictory messages from Janet Yellen and Jerome Powell, perhaps they had no phone signal yesterday because it certainly appeared like they didn’t communicate before firing very different salvos across the bows of financial markets:

- To calm the banking fears Jerome Powell, aka the Fed, raised interest rates by +0.25% while appearing to flag broader protection to depositors should financial stress spread as interest rates continue to rise.

- Treasury Secretary Yellen followed this “dovish hike” and market-friendly rhetoric by saying the government is not considering blanket deposit cover for deposit holders in US banks, at odds to what she said the prior day.

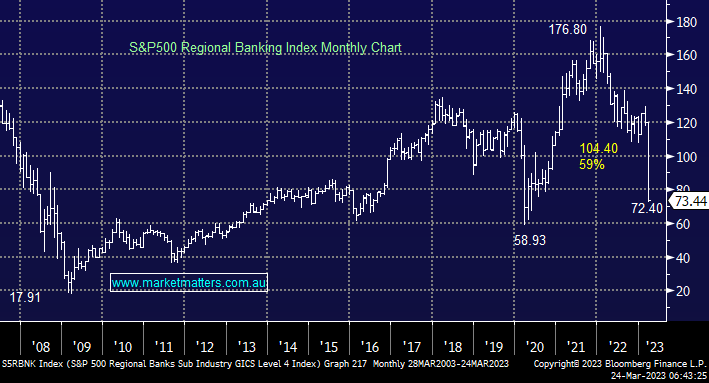

It’s extremely rare that two such influential powers in the US deliver such opposing messages within hours of each other especially considering the concerning volatility currently washing through the global banking sector – Yellen’s comments managed to send the US Regional Banking Sector down -5.7% in rapid fashion. We commented on Wednesday that “the Fed was again walking along the gymnast’s beam and last time they fell off!” this time it appears that Janet Yellen is trying to push them off before they even wobble themselves. It will be interesting if/how either party sees the need to try and calm markets over the next week but it’s likely to require a careful delivery after yesterday’s fiasco.

Under the hood yesterday we saw over 75% of stocks fall on broad-based selling with the Materials Sector the only one to fall by over 1% as renewed buying in gold names wasn’t enough to offset sharp declines in the ESG names which were ably supported by the large-cap miners – more on this later.

US stocks experienced another mixed session overnight after initially rallying strongly before indices then reversed before finally recovering as Yellen tried to undo her comments yesterday, the Dow closed up +0.2% while the tech-facing NASDAQ posted a gain of +1.3% – at about 6 am this morning Yellen said that “the US is prepared for additional deposit actions if required”, it appears that she’s been scolded by the powers that be but after watching the relative lack of impact it feels like the damage has already been inflicted on market confidence.

- Following the mixed performance across US indices the SPI Futures are pointing to another -0.6% drop locally not helped by a soft performance from US financials.

Janet Yellen knocked the regional banks another -5.7% on Wednesday night and unless they hear something convincing over the coming days it’s hard not to imagine them testing their 2023 low, another ~15% lower. Citigroup CEO Jane Fraser made an extremely scary comment about the vulnerability of smaller banks when investors start to pull their funds i.e. the advent of mobile apps has significantly increased the ability of customers to move millions of dollars with just a few quick keystrokes significantly changing the playing field in the process i.e. a bank could potentially fail due to a few quick tweets, that’s a scary and fundamentally illogical problem.

- Following the strange comments from the Treasury Secretary on Thursday we believe patience remains a virtue in regard to buying the US regional banks.

- The comments from her this morning may have theoretically said all the right things to support stocks but the damage may need further reassurances before markets can fully move on.