Last week we witnessed systemic failure fears escalate across the global banking sector, a cursory glance at the market’s preferred “flight to safety” vehicles over the last 5-days illustrates how these fears had grown:

- Gold rallied over $US100/oz last week to its highest level since April 2022 including a whopping $US50/oz gain on Friday.

- US 2-year Bond Yields plunged from 4.6% to 3.8% as investors/traders flocked to the safety of government bonds as future rate hikes were dismissed in just a matter of days.

- The new kid on the block, Bitcoin surged +30% to a fresh 10-month high, it’s evolved into a major beneficiary of market uncertainty as well as excess liquidity.

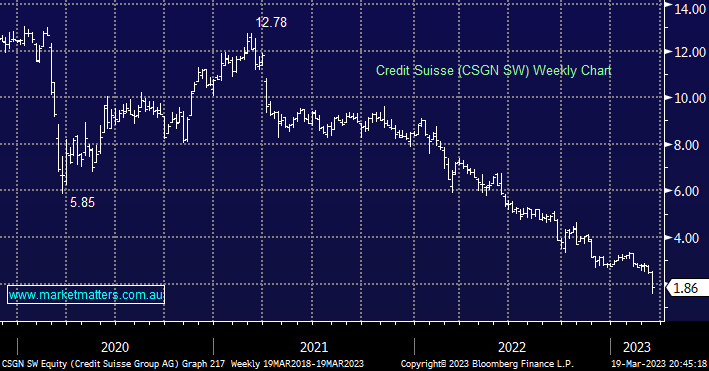

The unprecedented speed of rate hikes by central banks has caused the underlying issues across the global banking world with Credit Suisse having to fight hard not to follow Silicon Valley Bank (SIVB US) and Signature Bank (SBNY US) into insolvency.

- the Fed, ECB, and RBA were simply too slow to recognise inflation was permeating through the economy, and their subsequent sledgehammer-style reaction has arguably been even more embarrassing – the exact damages are still not 100% clear.

- It’s hard to imagine central banks will keep hiking in the coming months and risk compounding the already scary damage to the financial sector, logic says sit back for at least a few months and evaluate the fallout in consumer confidence.

MM remains fairly comfortable that the regulators will end the current panic sooner rather than later although that doesn’t mean the banks are a “screaming buy” they are likely to take time to regain investors’ full confidence – people love to knock the Australian banks but its times like now where we should feel blessed by their strength and stability.

- The Fed, FDIC, ECB, Warren Buffett, UBS, etc are all looking to regain market stability &/or benefit from the current volatility, at MM we believe they will ultimately be successful.

At this stage, MM believes we are witnessing a washout of a few badly run and overleveraged global banks but by definition when this purge is complete, which might even be early this week following the purchase of Credit Suisse by UBS, we expect stability will return and the quality banks that have been caught up in the sectors sell-off will bounce but it’s unlikely MM will go to market weight, let alone overweight, in the foreseeable future simply because the pullback by Australian banks has been very controlled.

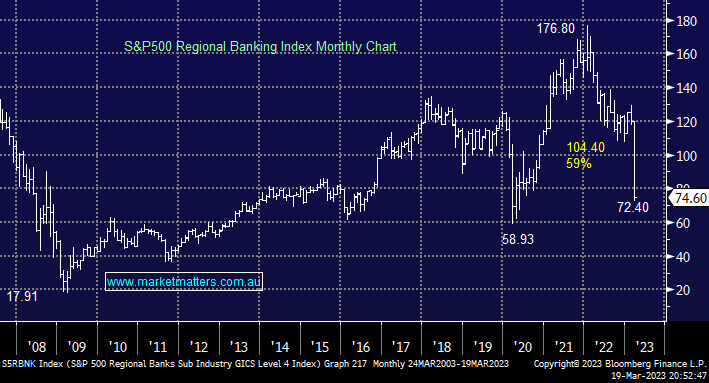

- The risk/reward is finally looking attractive for the US S&P500 regional banks after they’ve tumbled almost 60%.

- Markets should bounce this morning but confidence is a tough beast to forecast and volatility is unlikely to vanish in just 24 hours as stocks look for a new level of equilibrium.