What Matters Today in Markets: Listen Here each morning

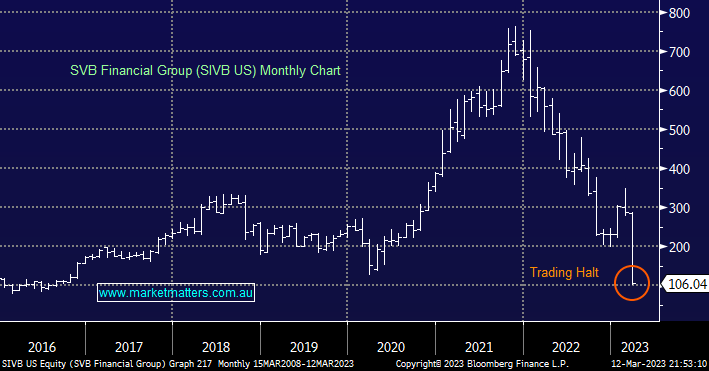

After numerous months of hanging on every word/innuendo from the Fed, RBA, BOE, et al we have a new gorilla in the room i.e. the collapse of Silicon Valley Bank (SIVB US), the 2nd largest bank to collapse in the US history. The wheels started to fall off last Wednesday when the company surprised the market by announcing it needed to raise $US2.2bn to shore up its balance sheet, the rest is already history as we witnessed a hysteria-induced run on the bank largely blamed on Venture Capitalists, customers withdrew a staggering $US42bn by the close of business on Thursday.

- Over 48 hours Silicon Valley Bank (SVB) went from being a previously well-capitalised bank to being in need of cash & looking down the barrel at the end of its 40-year history.

- Regulators have seized the bank’s deposits with the majority of remaining clients now facing an uncertain future – and this includes a number of ASX companies that are starting to disclose these issues this morning, Xero (XRO) is the only company we own so far and they say this was approx. ~$US5m – so inconsequential for them.

- The collapse of the bank which had thrived along with its tech neighbours is reverberating through global equities, the NASDAQ has already corrected close to 40% from its late 2021 high and this week it’s again facing yet another test of investor confidence.

Rising interest rates were ultimately the catalyst for this collapse, however, there was more at play with this lender:

- Banks borrow short and lend long, meaning that the interest rate the bank pays to depositors can differ from the rates they earn through their lending book – a differential/risk that a bank will hedge, however, this was not the case at SVB.

- As tech clients started withdrawing money to cope with the current tough trading environment – remember global tech companies are laying off staff in droves including over 125,000 this year alone in Australia, SVB found itself short of funds.

- This forced them to sell off all of its available-for-sale bonds for a whopping $1.8bn loss, hence the need to raise capital – and this caused a crisis of confidence.

- The huge influx of funds post-COVID as the tech bubble grew, was invested into US Treasuries when rates were zero hence the big loss when they became forced sellers i.e. the surge in interest rates over the last 12 months has sent bond prices lower.

- Investor confidence was already vulnerable after the collapse of crypto-focused Silvergate Bank and it was easy to understand the snowball which gathered momentum for SVB. The bank played its hand extremely poorly:

- The other key aspect here is the concentration of their book i.e. Heavily in technology. SVB was positioned for interest rates to remain around zero and the tech boom to continue indefinitely, a double whammy which in its case equated to insolvency.

NB FDIC stands for the Federal Deposit Insurance Corporation

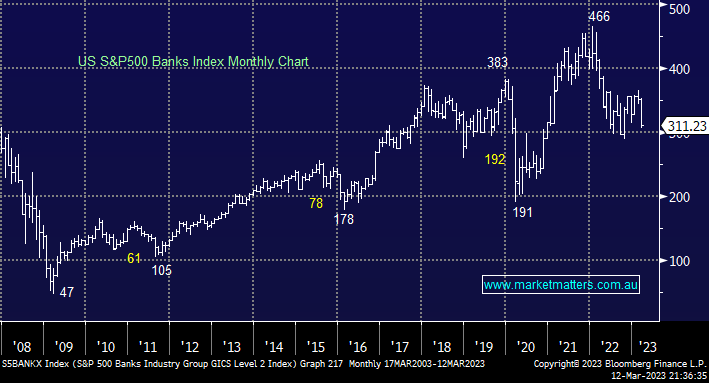

While the problems at SVB are company specific, there are risks of contagion if the situation is not resolved quickly, and there is no doubt this is having a huge impact on sentiment toward the Global Banking Sector

While volatility in the bond market can cause underlying issues more broadly, we do think this rings of opportunity with the big question being when/what should we start accumulating to even up our banking exposure. However in line with our recent comments on the likes of CBA, we are being patient with regards to increasing our underweight exposure – another 6-8% would likely see us start looking to increase our ANZ, MQG & NAB holdings.