Investor sentiment continues to change like the weather, only a few weeks ago we had markets starting to believe that peak inflation was behind us, central banks were about to ease off with the rate hikes and even rate cuts weren’t too far away. However, a trifecta of strong US data has led to Jerome Powell et al quickly redonning their hawkish hats a bit like they were hoping investors hadn’t noticed their pivotal comments just a few weeks ago:

- Back on the 7th of this month the Fed Chair said the “disinflationary process” has begun although “we will likely need to do additional rate increases” i.e. nothing too aggressive/hawkish at the start of February.

- Less than 2 weeks later following strong employment, inflation, and retail sales data Fed Officials have turned extremely hawkish and markets are placing a 50% possibility of a full 0.5% hike in rates next month.

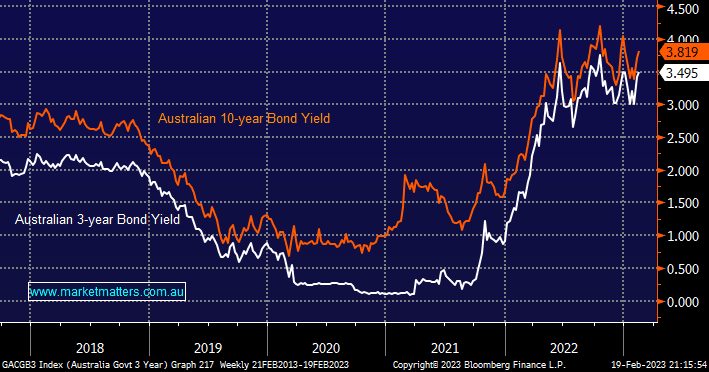

If we are correct this merry-go-round of market opinion will dominate 2023 as economists and investors alike attempt to 2nd guess the Fed, RBA, BOE & Co. The RBA Chair Philip Lowe has become increasingly hawkish as the year evolves with the senate hearing not dampening his aggressive stance towards inflation. In our opinion it’s simply a year to watch for elastic bands stretching too far and fading the respective moves whether it be too hawkish, dovish focused on a recession, a recovery, or rate cuts in 2024 – they are all probably going come into play this year in one form or another.

The Australian yield has not inverted as it has in the US which may surprise anyone with a large mortgage or a geared exposure to the Australian housing market. Exactly what comes next for the Australian economy is always open to conjecture but as higher mortgages start to bite we must remain cautious towards discretionary spending and a potential recession over the coming 12 months.

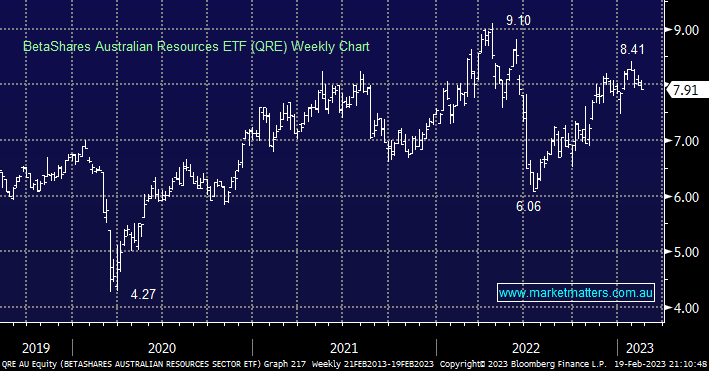

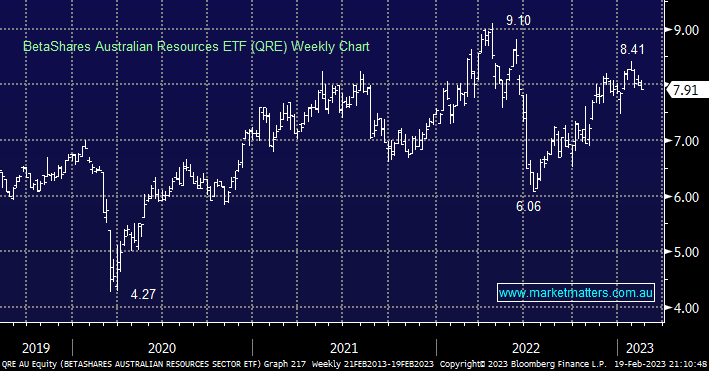

The market is certainly contemplating a potential recession looming on the horizon but the price action across most major resources stocks tells us investors aren’t convinced with the likes of BHP Group (BHP), Sandfire Resources (SFR), and South32 (S32) all up strongly year to date i.e. Chinas post-COVID reopening is expected to largely offset the damage inflicted on western economies by central banks.

- We are looking for a kick-up in the $US and recession fears to weigh on the resources space over the coming month (s).