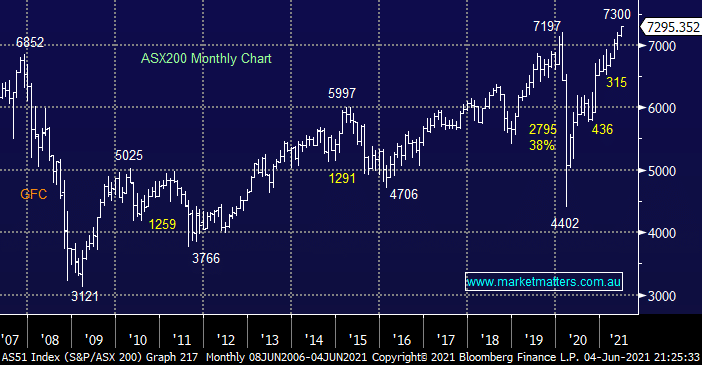

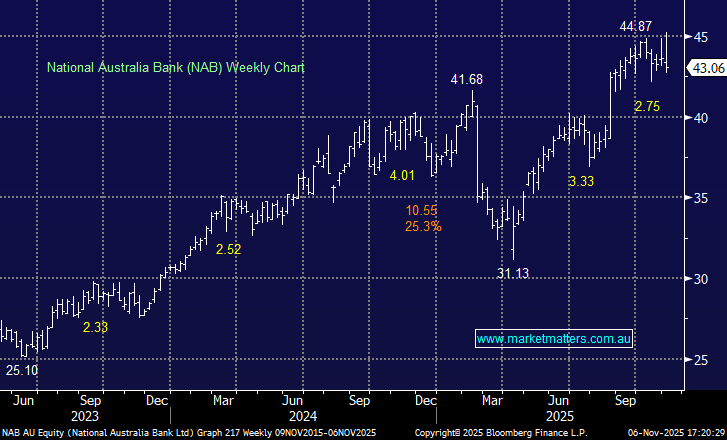

This morning the ASX200 appears poised to again test the 7300 area, if we assume the local index has already seen its low for June and the last couple of months have set the benchmark for the current breakout by Australian stocks investors should expect to see a test of 7400 in the coming weeks, a move that shouldn’t be hard to comprehend as the banks maintain their bullish charge, the average gain of the “Big 4” in 2021 is already over 28%, and that’s before we even consider their attractive dividends.

The press are jumping on the inflation bandwagon at present extrapolating it to mean interest rates will be hiked sooner rather than later, a move which they suggest will challenge the current sharp rise in asset prices such as stocks and property. At MM we believe that the doomsday merchants are focusing too much on selling papers / getting “clicks” as opposed to offering a more balanced approach to the looming changes in the global economic landscape:

- Bond yields have already rallied strongly in many economies including Europe, the US and Australia hence credit is slowly becoming more expensive and tougher to obtain e.g. fixed 4-year mortgages below 2% are no longer being touted by Australian lenders.

- Australians have reduced household debt while increasing savings over recent years with COVID accelerating the new relativcely conservative disposition.

- The vast majority of home loans were taken when prices were lower and interest rates higher therefore any reversal in both is likely to only impact a very small percentage of mortgage holders.

In a nutshell if prices were to “plummet” by say 20% it may disappoint many who are currently enjoying the nice “feel rich factor” but it would only take them back to levels of a few months ago, similarly if Commonwealth Bank (CBA) were to experience a dramatic $20 plunge it would only revert prices back to early March – we should all remember that corrections are a healthy ingredient of bull markets, straight line rallies are generally more likely to come undone with a crash.

Following a firm session on Wall Street on Friday the ASX200 is poised to open around its all-time high this morning, 7300 feels like it might become the new level of equilibrium as 7000 slowly slips into the rear view mirror of the local index.