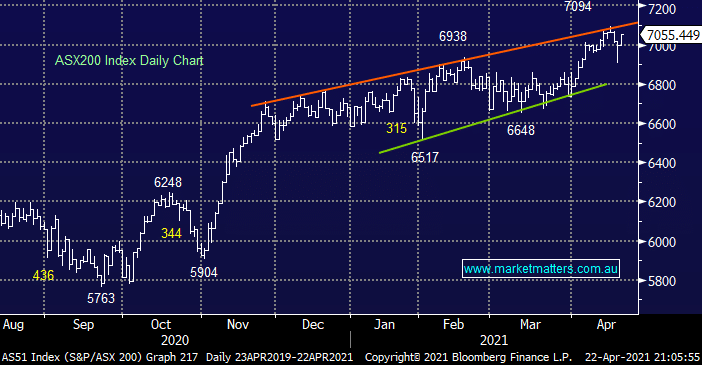

The ASX200 rallied strongly on Thursday after a fairly lacklustre start ultimately posting a solid +0.8% gain taking the market to within striking distance of its 2021 high. Gains were again broad based with almost 70% of the market closing up while heavyweights Commonwealth Bank (CBA), CSL Ltd (CSL) and BHP Group (BHP) all outperformed on the day. MM is looking for a pullback into May / June but there are no sell signals being generated – just yet.

It’s not unusual to see stocks surrounded in optimism come crashing down to earth after reporting below market expectations, the last few sessions has seen this phenomenon from a diversify array of names from Netflix (NFLX US) to Whitehaven (WHC). However the reverse was the standout yesterday with a couple of stocks MM owns, who carry large shorts positions, pop higher as the company proves it’s in better shape than many feared e.g. Megaport (MP1) rallied almost 10% hammering the almost 7% short position while HUB24 (HUB) rallied almost 5% again hurting the 5.2% short position.

This year has seen shorts in the US decimated by the “Reddit Army” with names like GameStop (GME US), AMC Entertainment (AMC US) and BlackBerry (BB US) surging in just 1-2 days leaving a trail of massive P&L losses across hedge funds. We’re not calling more of the same in Australia but I would be uncomfortable carrying a large short position in any stock that’s already dropped significantly – holding elevated cash levels is enough for us!

Overseas stocks were sold off aggressively into the close last night after Joe Biden proposed almost doubling the capital-gains tax for the wealthy giving plenty of reason for anyone considering taking profit to press the sell button sooner rather than later. The SPI futures are calling the ASX200 to open down around 20-points following the Dows 320-point decline.