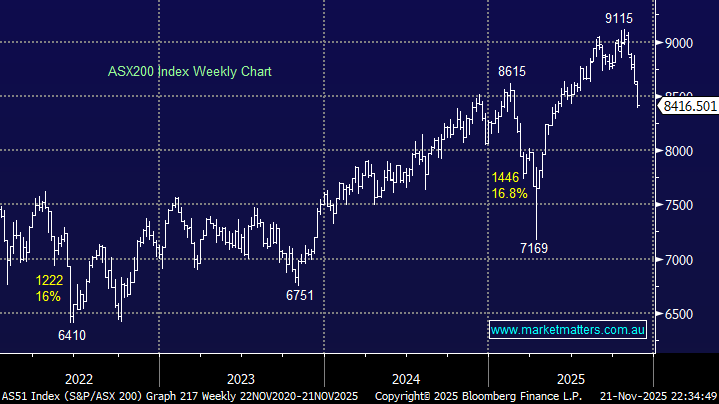

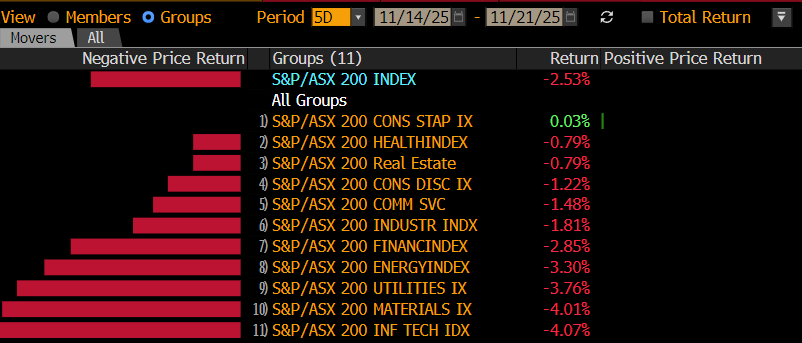

The ASX 200 ended the week down another -2.5% with only the defensive natured consumer staples sector managing to eke out a small gain. It was the local market’s worst week since “Liberation Day” with the index closing at its lowest level since June, on a combination of worries around stretched valuations and the direction of interest rates. On Friday, the local bourse closed 7.7% below its all-time high posted in October when the prospect of lower rates was managing to offset lingering fears around frothy valuations.

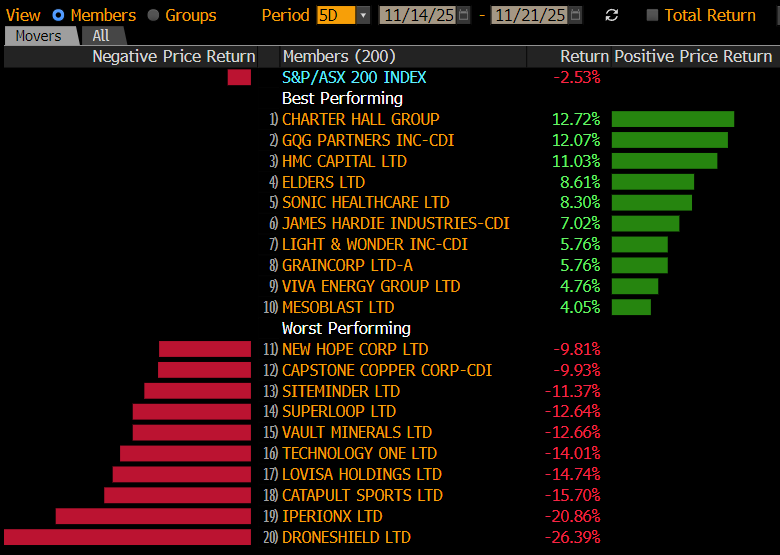

By Friday’s close, the losers’ enclosure was dominated by the tech stocks, even after a better performance on Friday, while all the “Big Four” banks fell by over 2%. As for the winners, the eclectic bunch were thin on the ground:

Winners: Charter Hall Group (CHC) +12.7%, GQG Partners Inc (GQG) +12.1%, HMC Capital (HMC) +11%, Elders (ELD) +8.6%, Sonic Healthcare (SHL) +8.3%, James Hardie (JHX) +7%, Light & Wonder (LNW) +5.8%, and Lynas (LYC) +3.7%.

Losers: DroneShield (DRO) -26.4%, Iperionx (IPX) -20.9%, Catapult Sports (CAT) -15.7%, Lovisa (LOV) -14.7%, Technology One (TNE) -14%, SiteMinder (SDR) -11.4%, Capstone Copper (CSC) -9.9%, Temple & Webster (TPW) -7.3%, and Westpac (WBC) -4.3%.

The global economic and geopolitical news was overshadowed by Nvidia’s last week, pretty much as expected:

- On Tuesday, the market showed its weak underbelly buckling under the weight of RBA inflation commentary, adding to weakness in tech as traders trimmed positions ahead of Nvidia’s earnings on Thursday.

- Thursday saw the ASX surge higher as investors bought “risk” after Nvidia delivered a blockbuster earnings report that blew past expectations on basically all metrics, reigniting the “AI Trade”.

- The mildly stronger-than-expected US jobs report on Thursday night dampened hopes of incoming interest rate cuts from the Fed, dragging on equities and risk assets sharply lower as Nvidia euphoria faded.

- Friday was the complete opposite in the rollercoaster week for the local bourse, falling 1.6% after US markets reversed their early Nvidia-inspired strength to ultimately close lower.

Friday saw overseas markets end the volatile week on a strong note. In Europe, the gains were more muted, as they missed the US gains. The French CAC and UK FTSE edged higher. However, in the US, late broad-based buying saw the S&P 500 rally +1.1% which saw all 11 sectors close higher after getting an injection of hope during the session as a Federal Reserve official suggested that another rate cut this year remains a possibility.

- The SPI Futures are calling the ASX200 to open up +1.2% on Monday morning following strength on Wall Street into the weekend.