- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

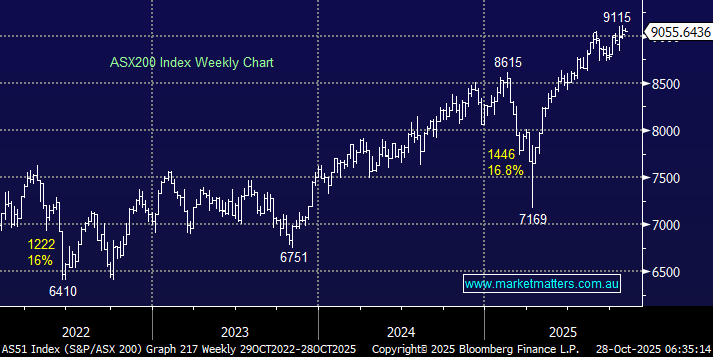

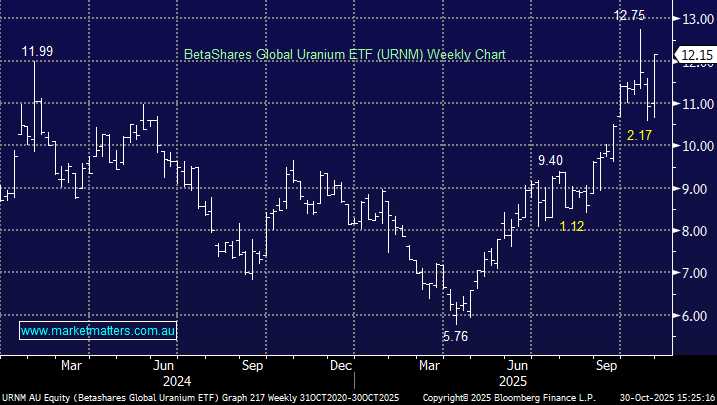

The ASX 200 advanced +0.4% on the last Monday of October, with winners and losers fairly evenly matched, but the influential banks and heavyweight resource stocks dragged the broader index higher. The combination of Friday’s strong session on Wall Street following the soft CPI and optimism over a US-China trade deal lifted the local market and US futures, which were up +0.7% when the domestic day session ended. The defensive names struggled with gold front and centre as the precious metal pushed down towards $US4,000 support on the trade news. Another sector under pressure was critical minerals as the Superpowers cozied up over their cocoa, demonstrating that explosive moves in the resources space often unravel hard and fast, especially when they’re news-driven. Some of the corrections over recent days have been savage:

Gold: Ramelius (RMS) -25%, Newmont (NEM) -20%, Bellevue Gold (BGL) -19%, Emerald Resources (EMR) -15%, Evolution Mining (EVBN) -15%, and Northern Star (NST) -13%.

Critical Minerals: Arafura Rare Earths (ARU) -42%, Iluka (ILU) -25%, Iperionx (IPX) -22%, Lynas (LYC) -19%

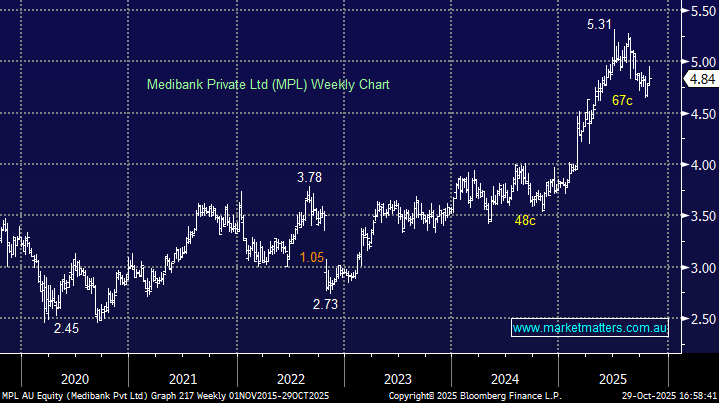

With Fed and RBA rate cuts expected into Christmas, US earnings season still delivering more beats than misses, and US-China trade talks appearing to progress nicely, there’s no obvious hurdle (s) to rein in the bull market. Interestingly, Goldman has said it’s time to structure portfolios more defensively; we wouldn’t argue fundamentally, but believe they’re too soon. MM prefers legendary trader Paul Tudor Jones’ take on the current market: he says investors are entering a “party like it’s 1999” phase, a period of euphoric price appreciation driven by loose monetary and fiscal policy that could end badly, but not before delivering explosive gains for those willing to dance near the fire.

- While MM remains in “buy the dip” mode, we continue to believe the real action into Christmas will unfold on the stock and sector level – the ideal environment for “Active Investors”.

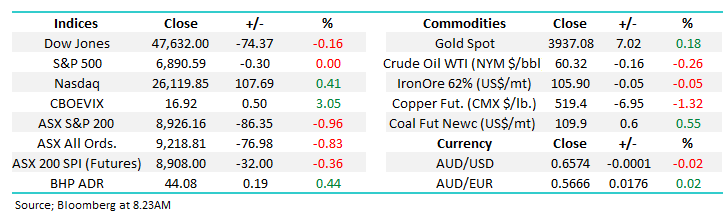

Overseas markets were firm on Monday night, mirroring the gains seen during our local session. In Europe, the German DAX rose by +0.3% and the French CAC added +0.2%. In the US, the tech-heavy NASDAQ led the advance, climbing +1.8%, while the broader S&P 500 gained +1.2%. Optimism that the US and China are moving closer to a trade agreement lifted risk sentiment, pushing equities to new all-time highs alongside a rally in cryptocurrencies. In contrast, demand for safe-haven assets weakened, with gold and short-term bonds both declining.

- The SPI futures are calling the ASX200 to open down 0.3% surrendering Monday’s gains, taking the index back towards the psychological 9000 level. Resources set to be the main drag.