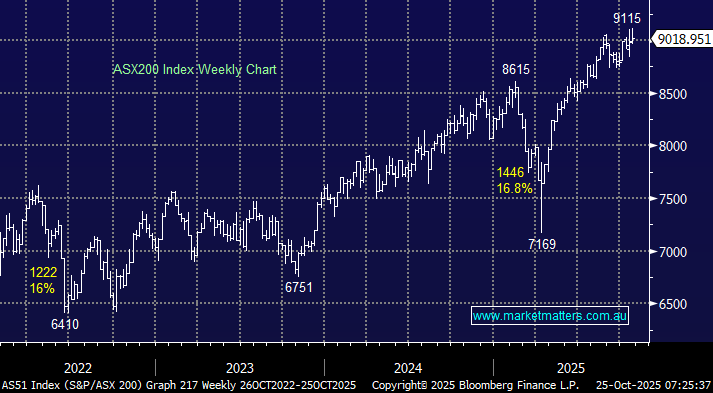

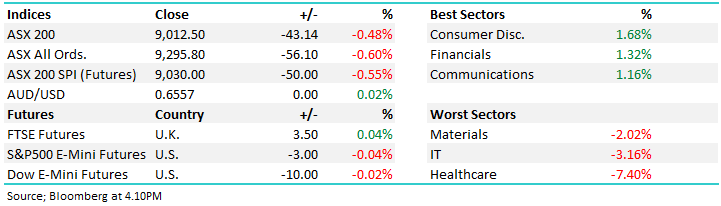

The ASX200 ended the week up +0.3% with 8 of the main 11 sectors advancing. It was another week that saw investors “buy dips” while preferring to rotate between stocks/sectors as opposed to selling the market per se. Momentum traders had a week to forget with precious metals stocks getting whacked as gold and silver experienced their worst day in more than a decade, and even on Friday, gold traded in a $US100/oz range, although it again held support ~$US4,000.

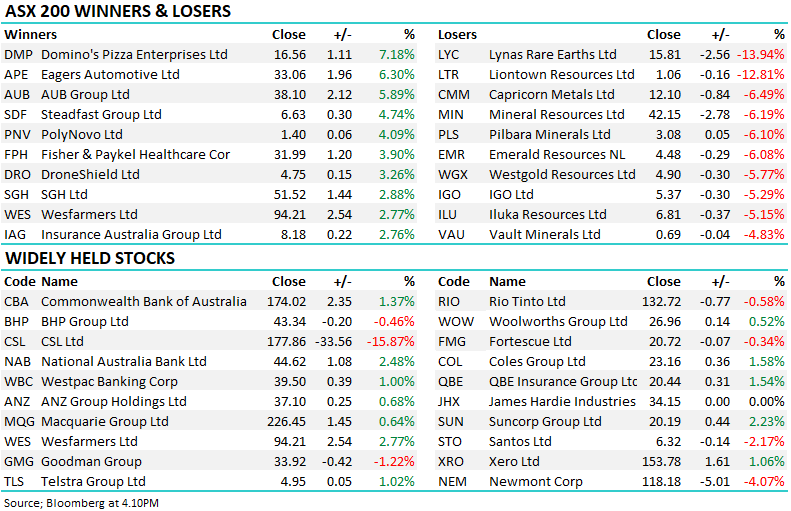

By Friday’s close, the winners’ enclosure was very stock and sector specific, with oil & gas names lifting the energy sector even while uranium names struggled. In the materials sector, aggressive profit-taking across the precious metals space was offset by buying in the lithium stocks:

Winners: Pilbara Minerals (PLS) +20.5%, Karoon Energy (KAR) +14.4%, Temple & Webster (TPW) +10.8%, Woodside Energy (WDS) +10.4%, IGO Ltd (IGO) +9.4%, Catapult Sports (CAT) +8.9%, Judo Capital (JDO) +8.3%, and Relance Worldwide (RWC) +7.5%.

Losers: Deep Yellow (DYL) -27.6%, Bapcor (BAP) -17.4%, Catalyst Metals (CYL) -16.6%, Bellevue Gold (BGL) -15.6%, Newmont (NEM) -15.2%, IDP Education (IEL) -10.3%, Zip (ZIP) -10.2%, Evolution Mining (EVN) -10%, Boss Energy (BOE) -8.8%, and Perpetual (PPT) -6.4%.

The global economic and geopolitical news had several moving parts last week, with US-China trade tensions coming back to the fore, and Anthony Albanese striking an attractive rare earths deal with President Trump:

- On Wednesday, Albanese and Trump struck a rare earths deal with both countries to spend $1 billion over the next six months on projects with additional outlays after that toward an $8.5 billion pipeline of critical minerals projects.

- Momentum traders suffered in the middle of the week, among them precious metals, crypto and companies in the AI space – although gold’s more than $US200/oz plunge dominated the news.

- Oil and gas stocks rallied into the weekend after US sanctions on Russian oil lifted crude prices.

- On Friday night, the US September consumer price index report, which was delayed because of the U.S. government shutdown, came in lower than expected, lifting hopes of Fed rate cuts sooner rather than later.

- This week should see the US and China sit down, while Canada is currently out in the cold, but it’s the talks between the superpowers that markets will focus on.

Overseas markets ended the week on a strong note, with the Dow closing above 47,000 for the first time. Softer inflation data boosted investor confidence that the Federal Reserve can stay the course on rate cuts, with futures markets now pricing in two reductions before Christmas as dovish sentiment takes hold. The rate-sensitive Russell 2000 gained +1.2% on Friday, while the S&P 500 rose +0.8%. In Europe, the EURO STOXX 50 and German DAX both edged +0.1% higher.

- The SPI Futures are calling the ASX200 to open up +0.3% on Monday following the strong session on Wall Street.