- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

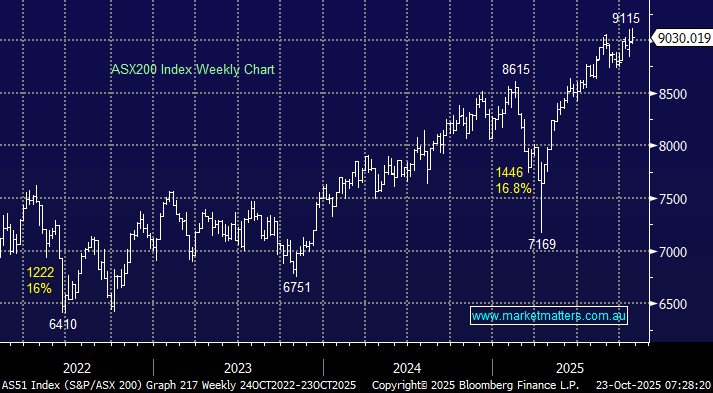

The ASX200 fell -0.7% on Wednesday, with volatility resurfacing in a session that saw stocks falling alongside gold and cryptocurrencies. It was a day in which assets favoured by retail momentum traders bore the worst losses, among them precious metals, crypto and companies in the artificial-intelligence space. Indexes used by quant investors to track the theme in the equity market, such as the Bloomberg US Pure Momentum Portfolio, have fallen sharply in recent days as we’ve seen a significant cooling in enthusiasm for areas of the market that, since the start of August, had gone “parabolic,” as investors and traders chased the “easy money” – it was always going to happen, when was the big question.

While it appears that, at least temporarily, the music has stopped and the party has ended for the markets’ most speculative names, we believe value will re-emerge fairly quickly, although it may take time for confidence to fully return. For example, we see good support in gold around the $US4,000 level, an area it bounced off yesterday, as the precious metal swung around in a $U150 range almost hourly, churning traders in its wake.

- We believe the pullback in gold stocks is already closer to its conclusion than its start point.

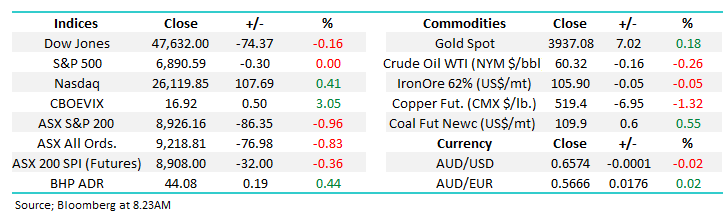

Overseas markets were volatile overnight as new developments out of Washington exacerbated concerns among investors about U.S.-China trade relations. We also saw disappointing corporate earnings from companies, including Texas Instruments and Netflix, with the streamer falling over 10%. In Europe, the German DAX and French CAC fell by -0.7% and -0.6% respectively. Loses were steeper in the US as the reporting season hit a few bumps in the road, with the small-cap Russell 2000 index leading the declines, falling -1.5% while the tech-based NASDAQ retreated -1%.

- The ASX200 is set to open down around -0.2% this morning, following the soft session on Wall Street. BHP was down 50c in the US.

A slightly different take on our report this morning, providing a bigger picture summation of our thoughts on AI, and the types of stocks we believe offer solid risk/reward at this stage of its evolution.