- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

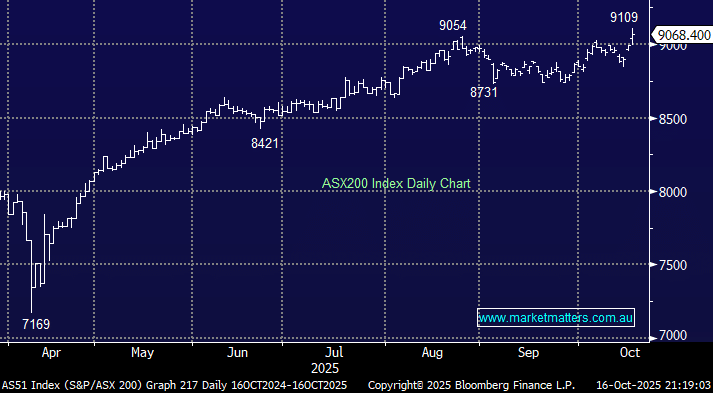

The ASX 200 enjoyed a surprisingly strong Thursday, after a lacklustre start to the day. Aggressive buying pushed the market above 9100 for the first time before surrendering some of the day’s gains through the afternoon to close up +0.9%. The catalyst for the move was weaker Australian employment data, which lifted hopes for an RBA rate cut, propelling the real estate, healthcare and financials higher. Australian unemployment jumped more than expected to a 4-year high of 4.5%, well above the forecasted 4.3%, and the economy added fewer jobs, strengthening the case for a rate cut.

- The futures market is now pricing in a ~70% chance of a rate cut on Melbourne Cup day, up from 40% just 24-hours before the data.

Gains were not broad-based, with almost 40% of the market closing lower, but stocks/sectors that did advance were influential enough to take the index to a record close. Strong moves by Macquarie Group (MQG), Goodman Group (GMG), and Commonwealth Bank (CBA) contributed over 40% of the index’s advance, illustrating the polarised nature of the day. Further stock/sector rotation/reversion was evident in the high-flying pockets of the market, with selling in copper, rare earths, lithium and defence stocks, although the gold sector continued to follow the precious metal to new highs.

- The ASX200 pushing new all-time highs at the start of the month is an encouraging sign for a run into 2026, as the Oct-Dec quarter is historically the strongest over recent decades.

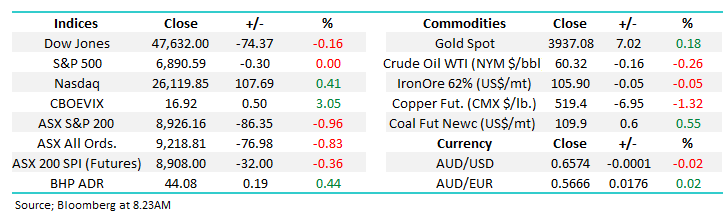

Overseas markets were mixed overnight following a late sell-off on Wall Street. In Europe, the EURO STOXX 50 closed up +0.8% while the UK FTSE edged +0.1% higher. In the US, the small-caps led the falls, closing down 2.1% while the S&P 500 finished the session down 0.6%.

- The SPI Futures are calling the ASX200 to open down 0.3% this morning after the weak session on Wall Street.