- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The ASX 200 opened lower as expected on Monday, but failed to capitalise on a steady advance in U.S. futures, with nearly half of the session’s losses occurring in the afternoon even as the S&P pushed higher. Perhaps it was the October jitters, but the local market appeared to lose some of its recent “Mojo”, with more than 70% of stocks finishing in the red and few bright spots beyond the gold and rare earth sectors. Still, the 0.8% decline was far milder than Friday’s bout of panic selling, which washed through US markets and was broadly in line with moves across Asian markets.

We’ve entered a new chapter in the US-China protectionist trade arm wrestle. However, there’s a subtle difference; China was the instigator with its decision to initiate export controls on rare earths. Sure, Trump initially reacted with significant bluster, but his administration quickly signalled openness on Sunday to a deal with China to quell fresh trade tensions while also warning that recent export controls announced by Beijing were a major barrier to talks. The remarks from Trump and Vance suggest that the US wants to keep up the pressure on China to reverse its most recent trade moves, while trying to reassure spooked markets that a tit-for-tat escalation isn’t inevitable.

- Beijing isn’t known for its about turns, unlike President Trump – “the Taco theory: Trump Always Chickens Out”.

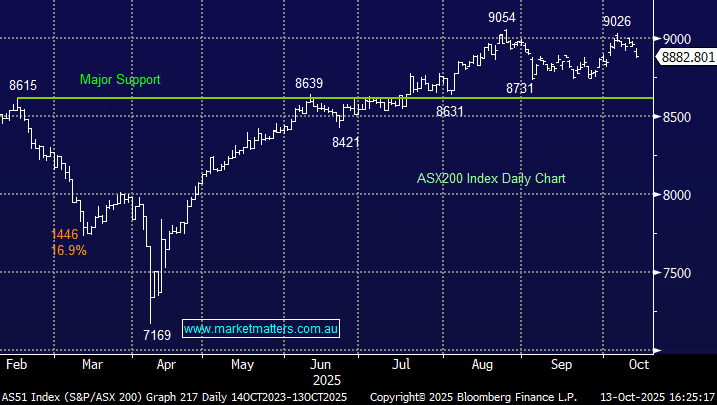

We think comments from Beijing will be key to whether the latest bout of October volatility is going to escalate further, potentially taking the ASX200 down towards major support ~8600. Overnight, risk assets rebounded on further softening of rhetoric between the two superpowers, and it seems for now we’re seeing posturing ahead of the meeting between Trump & Xi Jinping, earmarked for the 29th October.

Overseas markets bounced overnight, although they didn’t add a lot to the gains we saw on Monday in the Futures market. In Europe, the bounce was lacklustre with the German DAX closing up +0.6% while the UK FTSE finished its session up +0.2%. In the US, the small caps led the way with the Russell 2000 gaining +2.8% while the S&P 500 finished the day up +1.6%.

- The SPI futures are calling the ASX200 to open up +0.3%, more in line with the bounce in Europe, although a more than $1 bounce by BHP should help the ASX.

As we touched on in yesterday’s Match Out Report ANZ enjoyed a strong start to the week rallying +3.3% even as the market crumbled around it. We liked the news from the new CEO, Nuno Matos, at their strategy day with a focus on discipline, cost control and culture. Who would have thought halting a buyback and going back to basics by hiring more branch-based mortgage lenders and business bankers would go down so well? The first part of the equation certainly didn’t pan out for Treasury Wines (TWE), which plunged over 15% after halting its buyback, although it did come with plenty of additional bad news.

- We remain long and bullish on ANZ in our Active Growth and Active Income Portfolios, but after outperforming CBA by ~27% over the last 3 months, we thought this morning was an ideal time to quickly reevaluate our banking exposure.

Note: In the Active Growth Portfolio, we hold 6% in ANZ Group and 5% in Westpac, putting us underweight, primarily as we don’t hold market heavyweight CBA.