- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

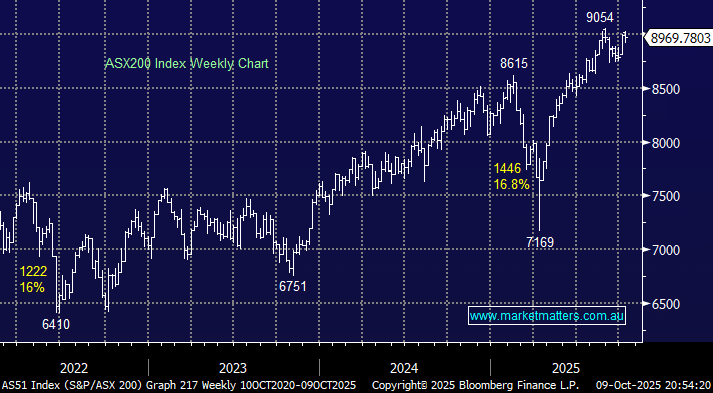

The ASX 200 rose +0.3% on Thursday, though the real action played out beneath the market’s surface, with the materials sector leading the charge, up +1.8% despite a rare pullback in gold stocks. Copper names stole the spotlight, with Capstone Copper (CSC) and Sandfire Resources (SFR) hitting new all-time highs. From an index perspective, BHP Group (BHP) was the clear standout, adding over 20-points, roughly 90% of the day’s gain, while CBA and NAB weighed on the market, each falling more than 1% as Goldman’s labelled them both as a sell. After a lacklustre start to the year, the performance baton has been firmly passed along the line, while the main index remains up almost 10%:

- Year-to-date, the Materials Sector is up +21.9% compared to the Healthcare Sector, which continues to carry the wooden spoon; currently, it’s down -14.1%.

The copper bulls like ourselves will likely surrender some paper profits this morning after Hadrian Capital Partners sold roughly half of its stake in Capstone (CSC) for $688mn, at a 6.7% discount to yesterday’s close. Dual-listed CSC had advanced just over 50% year-to-date, including a +12.5% surge this week, before the sell-down, which might lead to some consolidation in the stock/sector, but we believe investors should continue to “buy the dip” in copper names until further notice.

Overseas markets were soft across the board overnight. In Europe, the EURO STOXX 50 and UK FTSE retreated 0.4%. In the US, the pullback was similar, with the S&P 500 falling 0.3% and the Russell 2000 small-caps 0.6%. Gold caught some headlines tumbling more than $US65 in a volatile session that saw it down over $US100 at one stage, trading closer to $3900 than the psychological $US4000.

- The SPI Futures are calling the ASX200 to open down 0.4%, wiping out yesterday’s gain, with the miners likely to struggle early.