- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

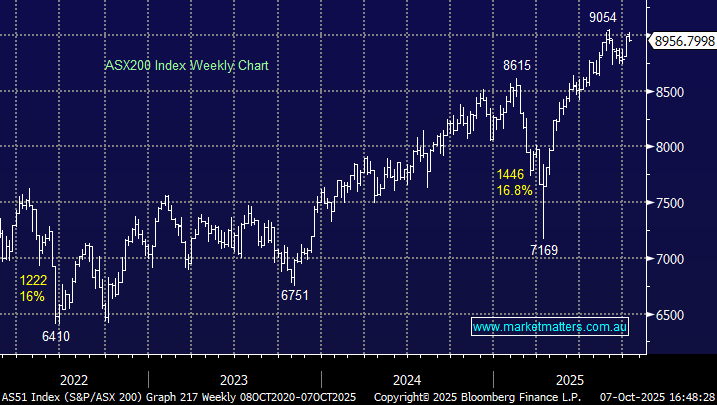

The ASX200 peeled away 0.3% on Tuesday, the first “real” day of trading this week, although losses weren’t overly broad-based, with 40% of the main board closing higher. While the retailers led the decline, it was noticeable to see some profit-taking wash through many pockets of the market as the US government lockdown drags on, even some gold names closed lower, despite the precious metal posting fresh highs. There are no sell signals, but the market feels tired whenever it ventures above the psychological 9000 level.

- We can see the ASX200 trading between 8700 and 9000 into the important inflation data at the end of the month.

Both bond and currency markets have started the week in a quiet fashion, with futures markets calling the prospect of a rate cut by Christmas a coin toss. However, according to the AFR’s latest quarterly survey, most economists still expect the RBA to cut interest rates on Melbourne Cup Day, followed by one more in 2026, despite recent concerns that inflation is starting to heat up – we feel they’re a touch too optimistic at this stage. RBA governor Michele Bullock has already tried to lower expectations for further cuts this easing cycle, and any upside surprise to core inflation in the September quarter data, to be released on October 29th, could see the RBA go on hold until further notice.

- The upcoming CPI release later this month will be pivotal, likely determining whether the RBA delivers two rate cuts over the next year, or none at all.

Overseas markets were generally soft overnight as the S&P 500 suffered its first decline in 8 days. In Europe, the EURO STOXX 50 slipped 0.3% while the UK FTSE closed up +0.1%. In the US, a late sell-off in Big Tech names saw the NASDAQ close down 0.6% while the Dow fared better, only ending the session down 0.2%.

- The ASX200 is set to open flat this morning despite the weakness on Wall Street.