- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

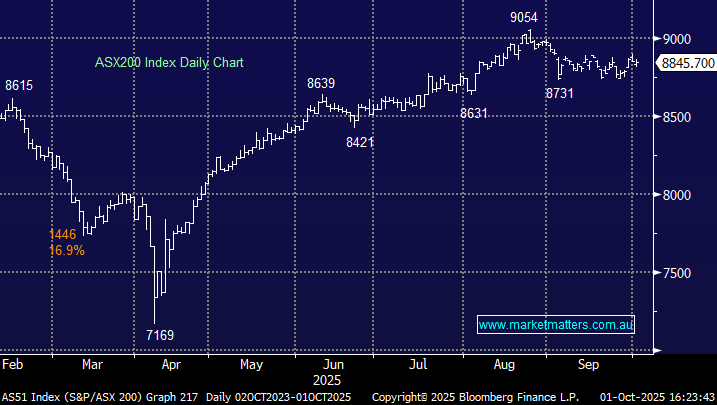

After a choppy session, the ASX200 closed slightly lower on the first day of October, with BHP Group (BHP) shaving 17 points off the index, which ultimately slipped just three points. The market seesawed through the day as investors weighed reports of a halt to BHP’s China-bound iron ore shipments alongside concerns over a potential U.S. government shutdown. Earlier this year, traders coined the acronym TACO (Trump Always Chickens Out) to capture how markets dismissed the threat of tariffs. In much the same way, today’s price action suggests investors expect the government shutdown to resolve without meaningful disruption to equities, consistent with past episodes.

The RBA’s decision to hold rates on Tuesday, coupled with mildly hawkish commentary, had little follow-through impact on equities yesterday, with no sector moving more than 1%. Yet, with inflation remaining sticky and labour costs rising amid stagnant productivity, it’s unsurprising that credit markets have pared back expectations for further cuts, with another move before Christmas now seen as a coin toss. While the rate-driven trade appears to be maturing, it remains hard to ignore stocks like APA Group (APA), offering yields above 6% at a time when many term deposits are drifting toward 3%.

The local market has been anchored to the 8800 level for the last four weeks; it’s feeling overdue to break in at least one direction, but until we see the market move more as one, as opposed to ongoing switching between sectors, the game will remain the same. With US stocks having now strung together four positive days, notching new highs along the way, some performance catch-up by local stocks wouldn’t surprise as we start the new quarter.

Overseas markets were again firm overnight despite the US government shutdown. In Europe, the UK FTSE and German DAX closed up +1%. The broad-based S&P 500 and Russell 2000 small-cap index closed up +0.4% in the US.

- The SPI Futures are calling the ASX200 to open up +0.6% this morning, helped by BHP’s 80c recovery in US trade.