- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

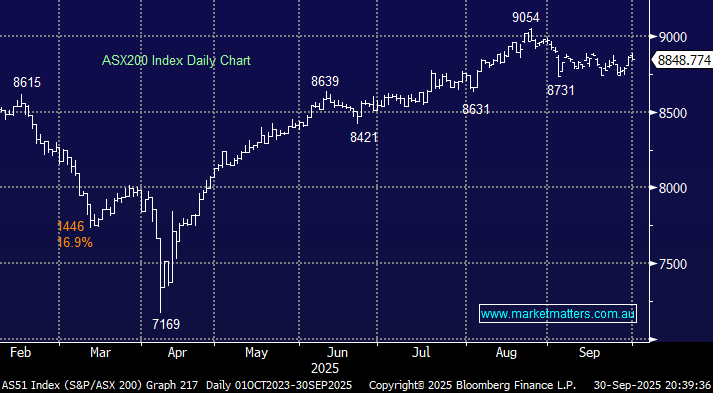

The ASX200 slipped 0.2% on Tuesday after the RBA and Michele Bullock threw a wet towel over the “Rate Cut Party”, although she really only maintained her logical, cautious narrative:

- The RBA left interest rates on hold at 3.6%, after 3 previous easing’s in 2025; the move was built into markets, but the commentary was slightly more hawkish than some hoped.

- Futures markets are now pricing in a 50% chance of a rate cut before Christmas as “The board sees the risks as broadly balanced and it remains data-driven.”

- The September quarterly inflation report, due later this month, is likely to determine whether mortgage holders enjoy some early Christmas cheer on Melbourne Cup day.

Considering the RBA caused the market to pare back its rate cut hopes, it was a quiet Tuesday with almost 40% of the main board closing higher. The banking shares weighed on the index through another noticeably polarised session, where another solid session by the copper and gold stocks supported the market. September may have traded primarily sideways, but it was still the Australian market’s worst month since March, although a +4.6% gain by the materials sector helped stem the losses, with the ASX finishing off 1.4% for the month, though a lot of dividends were paid.

- Supply concerns continued to fuel gains by pure copper miners such as Capstone Copper (CSC) +4.1%, Sandfire Resources (SFR) +2.7% while also supporting diversified heavyweights BHP +1.5% and Rio Tinto +0.6%.

- Gold stocks rose as concerns over a US government shutdown increased, lifting shares of Asian metals producers; Zijin Gold International Co., a unit of a Chinese miner, surged as much as 66% in its Hong Kong debut.

Overseas markets were again strong despite the looming risk of a US government shutdown. In Europe, the EURO STOXX 50 closed up +0.4%, and the UK FTSE +0.5%. In the US, a late rally saw the broad-based S&P 500 end up +0.4%, while the Dow finished up +0.2%. Gold caught the eye, rotating in a large $US80 range, although it managed to recover from selling to close above $3850/oz.

- The ASX200 is set to open marginally lower this morning, with BHP ending down 35c in the US following mixed commentary around a Chinese ban of the mining giant’s iron ore.