- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

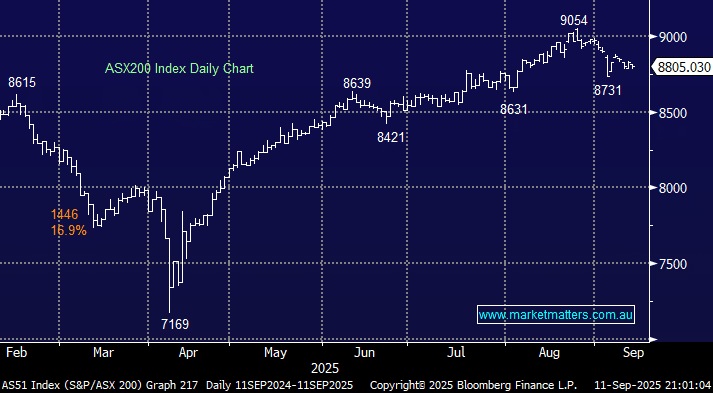

The ASX 200 retreated 0.3% on Thursday, with the losses in the banking sector catching the eye after Bendigo (BEN) became the third bank this week to announce job cuts. Ahead of a massive week for central bank decisions and local data, the Australian market has entered a holding pattern, although it does concern us that the index is around 250 points below last month’s all-time high while the S&P continues to post fresh highs.

- Next week, the Bank of Japan (BOJ), Bank of England (BOE), and US Fed all meet, plus the far from inconsequential Australian jobs data on Thursday – movement is afoot!

On the stock/sector front, Thursday was essentially a day of reversion from Wednesday, with the banking and healthcare sectors weak. The energy segment snapped a four-day losing streak, and the raw materials sector posted its first positive day in a week. A bounce in lithium stocks ably supported substantial gains from gold stocks. It felt like a fund, or funds, pressed the buy button for gold stocks for no apparent reason from a timing perspective, with the precious metal lower over the last 48 hours, but Evolution Mining (EVN) and Regis Resources (RRL) both surged over 6%. However, it should be noted that gold hit a new inflation-adjusted peak this week, which could have triggered the fresh buying.

- We continue to be wary of gold around $US3600, but we haven’t pressed any sell buttons yet as the trend remains our friend.

Overseas markets were strong overnight after August’s CPI came in a touch above expectations on a monthly basis but in line with expectations on an annual basis. Most importantly, it was not rich enough to derail the hopes of a Fed rate cut next week and certainly does not signal any sort of sharp post tariff reacceleration as many had feared. The path of least resistance remains on the upside, the S&P 500 advanced +0.9% and the Dow put on 600 points, or +1.4%, posting a fresh all-time high. In Europe, it was green across the board with the UK FTSE advancing +0.8%, and the EURO STOXX 50 gained +0.5%.

- The SPI Futures are calling the ASX200 to open up +0.5% this morning following strong advances by overseas bourses, helped by BHP’s gain ~ of 1% in the US.