- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

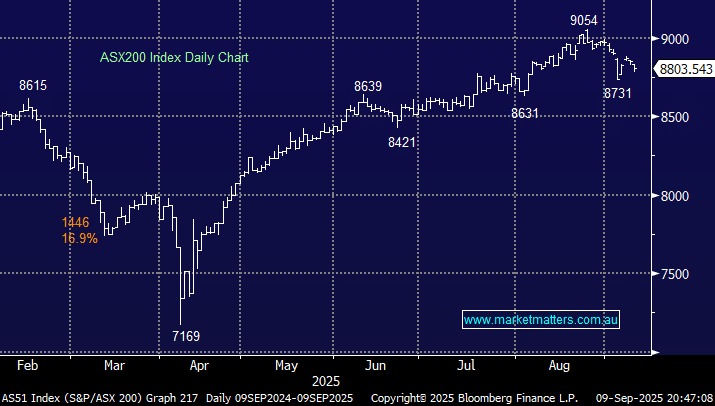

The ASX200 slipped another 0.5% on Tuesday, extending September’s retreat to 1.9% as the often weak month follows the seasonality script to a tee. Banking shares led the index fall, with heavyweight CBA worst on ground, closing down 1.3%. Gold stocks continued to shine as the market goes “all in” on a Fed rate cut next week; elsewhere, other rate-sensitive names like the retailers and tech stocks continue to outperform. Iron ore names caught the eye, trading mixed, even with the bulk commodity trading at fresh 2025 highs. The local index has now drifted over 3.5% from its late August high, a concern in the short term, with US stocks hitting new highs.

- Our preferred scenario is the ASX200 tests 8650 in the coming weeks, with 8450 still a distinct possibility.

As MM has elevated cash levels across most of our portfolios, we are looking to increase market exposure during the current weakness, but we see no urgency yet. We are conscious of the widely anticipated interest rate cut next week, and if we see a run-up by US stocks into the decision, it will heighten the risk of a classic “buy on rumour, sell on fact” move, one that the ASX is already starting to pre-empt – a reason we are adopting a patient approach.

Overseas markets were largely firm overnight with a couple of exceptions. In Europe, the UK FTSE closed +0.2% higher while the German DAX retreated 0.4%. In the US, the S&P 500 and NASDAQ advanced +0.3% but the more rate-sensitive Russell 2000 slipped 0.5%.

- The ASX200 is set to open flat this morning, ignoring moves on overseas bourses, with BHP falling around 1% in US trade, not helping the local index.