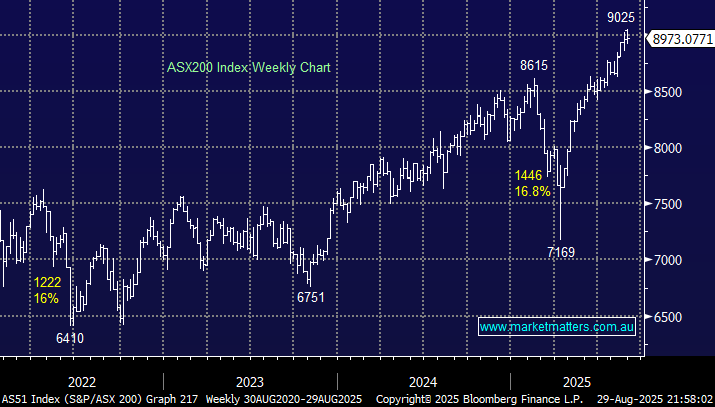

The ASX200 slipped 0.1% lower on Friday, but it still finished the week up +0.1%. As we’ve said a few times lately, it’s feeling a touch tired above 9000. It was another week to remember from a reporting perspective, which dominated much of the movement on the sector level, although the materials sector continued to enjoy a strong recovery, topping the leader board for the week and month.

By Friday’s close, the winners and losers enclosure was dominated by beats & misses through reporting, no great surprise this time of year:

Winners: Tabcorp (TAH) +40%, SiteMinder (SDR) +32.1%, Eagers (APE) +25.7%, Lovisa (LOV) +22.5%, PolyNovo (PNV) +19.6%, Paladin (PDN) 18.8%, Pilbara (PLS) +16.1%, Austal (ASB) +14.1%, Coles (COL) +14.5%, Worley (WOR) +13.8%, Zip (ZIP) +13.6%, and SmartGroup (SIQ) +13.1%.

Losers: Dominos (DMP) -22%, Reece (REH) -20.7%, Telix (TLX) 20.4%, EVT Ltd (EVT) -18.1%, Woolworths (WOW) -13%, Imdex (IMD) -10.4%, Wisetech Global (WTC) -9.6%, Bank of Queensland (BOQ) -9.4%, Oorora (ORA) -8.4%, and Macquarie Technology (MAQ) -7.6%.

- The markets opened with a bang on Monday morning following an almost 850-point rally by the Dow following a more dovish than expected speech by Jerome Powell from Jackson Hole.

- Wednesday’s local CPI came in hotter than expected, which has seen the futures market reduce the chances of a rate cut in September to 18%.

- On Thursday morning, we saw another solid result from Nvidia (NVDA US), which allayed many investors’ fears about the AI trade losing momentum.

- On Thursday night, Lynas (LYC) reminded us how hard some stocks/sectors have run, as they went to market to raise $750mn.

- US stocks slipped on Friday, but the S&P 500 registered its fourth consecutive monthly gain.

- US Core PCE, a key inflation measure watched by the Fed, increased by 2.9% in July, in line with expectations but an acceleration from the prior month and the highest level since February.

Overseas markets ended the week softly, with weakness across all major indices. In Europe, the German DAX and French CAC fell 0.6% and 0.8%, respectively. In the US, tech stocks led the weakness with the NASDAQ falling 1.2%, and the S&P 500 falling 0.6%.

- The SPI Futures are calling the ASX200 to open down 0.3% on the first trading session of September, following the weak session on Wall Street