- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

- Market Matters Reporting Calendar: Australian FY25 Reporting Calendar in PDF Here & Spreadsheet Here.

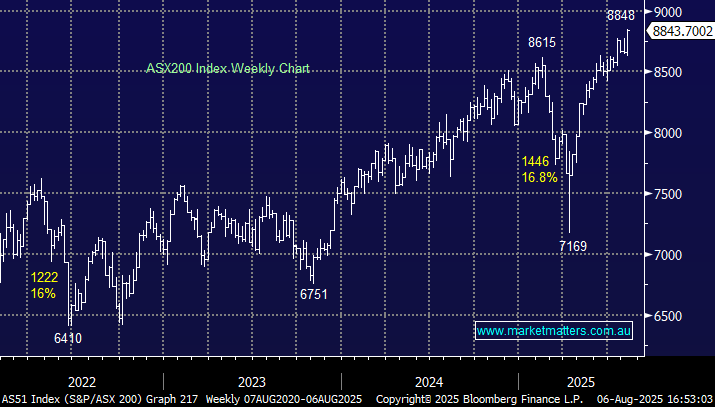

The ASX200 surged another +0.8% on Wednesday, closing at a fresh all-time high, and well above the psychological 8800 for the first time. Over 75% of the main board closed higher, but the main drivers of the more than 70-point advance were the heavyweight financials and materials sectors, which combined made up almost 60% of the indexes gain. Over recent sessions, the catalyst for strength both home and abroad has been the prospect of interest rate cuts, with the RBA expected to cut by 0.25% next week, and the Fed in September. Unless Michele broadsides the market for a second time, the prospect of lower rates looks set to support local stocks into Christmas.

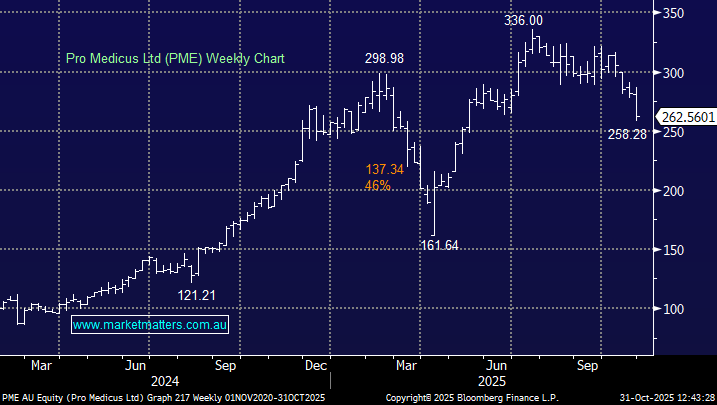

Although the market remains on a solid footing as we enter reporting season, companies need to deliver, especially those trading on lofty valuations. Interestingly, again we saw some profit taking in pockets of the “Certainty Trade” while the relatively cheap energy and mining stocks enjoyed a bid, although the underlying commodities have been flat over recent days: JB Hi-Fi (JBH) -1.3% and ResMed (RMD) -1.5%, versus Whitehaven Coal (WHC) +2%, and South32 (S32) +1.4%. We’ve written a few times in recent months that if the miners could join the bullish party, the ASX200 could easily be trading in the 8800-9000 area, that’s now old news!

- From a technical perspective, the bull market remains intact while we remain above 8750.

Overseas markets were firm overnight, mirroring the strength shown by the S&P futures during our day session. In Europe, the EURO STOXX 50 and German DAX both closed 0.3% higher. In the US, the tech-based NASDAQ led the gains, finishing up 1.3% while the S&P 500 closed up 0.7%.

- The SPI Futures are calling the ASX200 to open down 0.3% this morning, surrendering some of yesterday’s gains.