- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

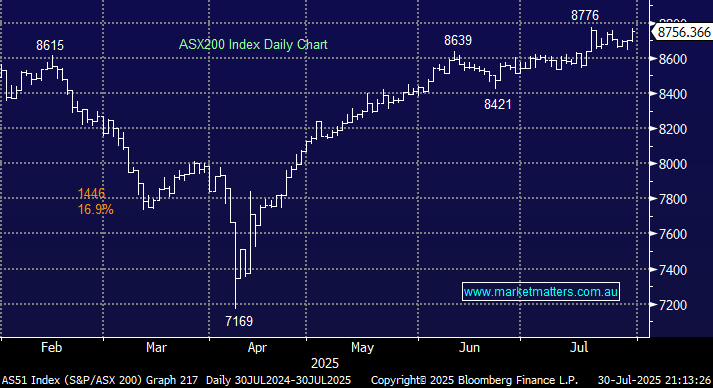

The ASX200 surged +0.6% on Wednesday, closing within 0.2% of its all-time trading high after the soft inflation print ignited the rate-sensitive stocks/sectors. Real estate, consumer discretionary, and the financials all closed up more than 1%. If the heavyweight miners had managed to attract a little love, the main index would have been knocking on the door of the psychological 8800 level. Assuming the RBA cash rate is going to push down towards 3% in the next six months, a number of heavyweight names are still offering attractive fully franked yields, providing a real tailwind for stocks. For example, ANZ is forecast to yield well above 5% fully franked over the coming 12-months.

- We believe the rate-sensitive stocks will perform strongly through at least the first or second rate cuts.

Sentiment on the day we termed as optimistically measured, as some companies start to deliver their earnings; overnight, Rio Tinto (RIO) reported underlying profit for the first half-year of $4.81 billion, missing the consensus estimate of $5.17 billion. The miners have been a drag on the index over the last week due to a lack of fresh stimulus news out of China, with RIO unlikely to help attract fresh buyers into the space this morning. However, Trump is likely to “smack” a number of ASX miners this morning after exempting refined copper from his 50% tariffs, sending copper prices in the US crashing lower:

- December Comex Copper ended the volatile session down a whopping ~19% while US mining giant Freeport-McMoRan Inc (FCX US) tumbled 9.5%, a stock we hold in our International Equities Portfolio.

- Copper on the LME was unchanged, with the spread between Comex and the LME evaporating. The LME price is more relevant to local producers.

Overseas markets were mixed overnight after the Fed left interest rates unchanged, as was broadly expected. In Europe, the EURO STOXX 50 advanced +0.3% and the French CAC +0.1%. In the US, the S&P 500 slipped 0.1%, while the tech-based NASDAQ advanced 0.2% ahead of major Magnificent Seven earnings.

- The SPI Futures are calling the ASX200 to open down 0.3% following Trump’s disruption of the copper market, BHP closed down ~90c in US trade.

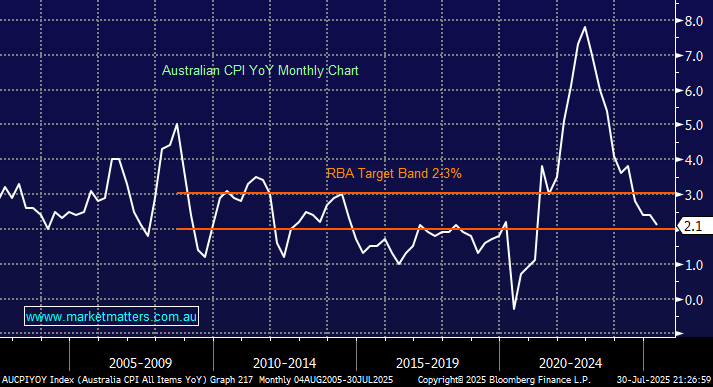

The big news on Wednesday was the soft inflation data which opened the door for the RBA to cut interest rates three times in the next six months, with the third now a better than 50-50 chance before Christmas. Bond traders increased their rate cut bets after the Consumer Price Index (CPI) for the June quarter slowed to an annual rate of 2.1% from 2.4%. The only market which didn’t like the better-than-expected inflation numbers was the Aussie Dollar, which slipped back under 65c in anticipation of a decent easing cycle.

- We believe the RBA will finally cut interest rates by 0.25% in August following yesterdays CPI.

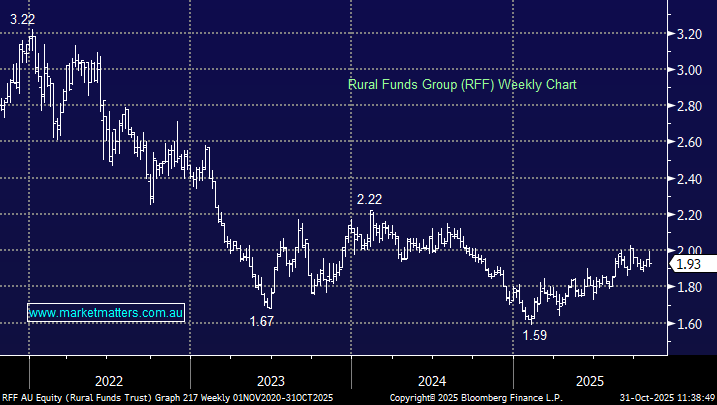

All of the main boards real estate stocks advanced on Wednesday following the sector friendly CPI, this morning we have updated our thoughts on the two sector positions we hold.