- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

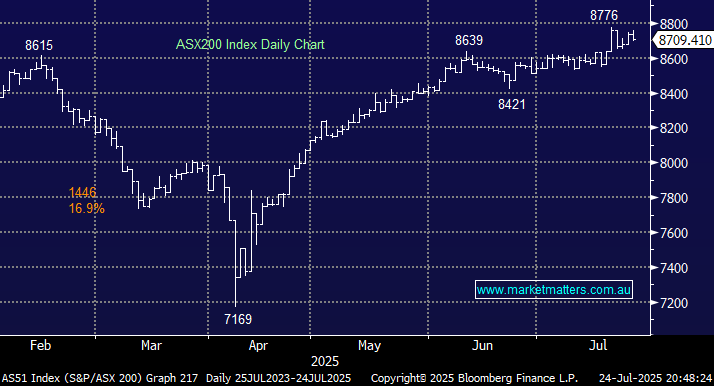

The ASX 200 keeps teasing us with a significant breakout on the upside before gains are tempered by macro &/or geopolitical news. On Thursday, it was the RBA with Michele Bullock delivering a less dovish speech than hoped by many, warning that underlying inflation may not fall as quickly as anticipated, signalling that an interest rate cut next month is not guaranteed – futures markets are still pricing it as a certainty, with a 40% chance of a third before Christmas. Overall, she delivered a very balanced speech with next week’s CPI inflation print a pivotal number while warning that although the central bank expects headline inflation to fall to the lower part of the 2-3% target band, Bullock said it is likely to bounce back towards 3% at the end of the year as temporary government electricity rebates expire.

- At MM, we expect only two rate cuts by Christmas, with the RBA likely to remain conservative as it considers the impact of tariffs on local and global inflation.

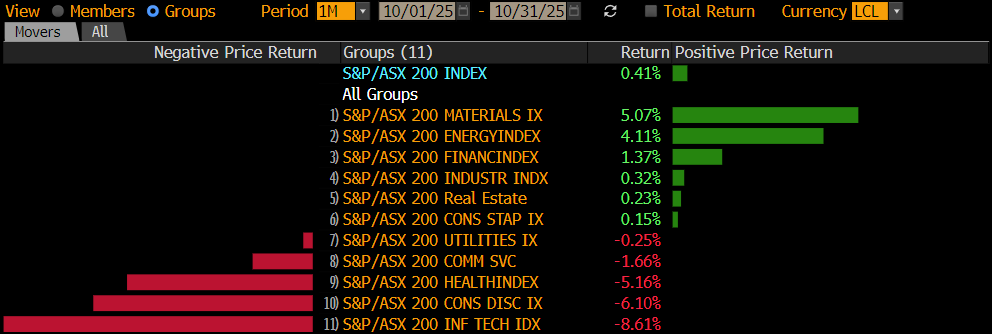

Following the comments from the RBA Governor, where she reiterated a “measured and gradual” path of easing, selling washed through the local market, with the rate-sensitive names attracting much of the attention. None of the 20 real estate stocks in the ASX200 managed to close higher, while the retailers didn’t fare much better. On the stock level, volatility remains extreme as company news flow drives aggressive moves in both directions; we were delighted not to own Bapcor (BAP) on Thursday, as it tumbled over 28%, conversely, we were happy to hold Pexa (PXA) +16.5% in our Emerging Companies Portfolio.

- We remain bullish towards the ASX200 into Christmas, but we still see ongoing polarisation on both the sector and stock level, likely to be amplified as FY25 earnings kick off in August.

Overseas markets were again mixed overnight. In Europe, the French CAC slipped -0.4% while the UK FTSE advanced +0.9%. In the US, a strong tech sector helped the S&P 500 eke out a +0.1% gain, while the Dow fell 0.7% following IBM’s more than 7% drop following an earnings miss.

- The SPI Futures are calling the ASX200 to open down 0.4% this morning following the mixed night on overseas bourses and 50c drop by BHP in the US.