- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The ASX200 closed down more than 1% on Monday, enduring its worst drop in three months. The last two trading days have seen similar see-saw action to a pair of days in early April, hopefully it’s not a precursor of the volatility ahead! Monday’s losses were the ASX200’s most severe since a 1.8% drop on April 9, while Friday’s 1.4% gain was the index’s best since a 2.3% rally on April 8th. The market closed down 89 points, with over 75% of the decline courtesy of the financials, while the miners and energy stocks tried to support the index, but the losses in the banks were overwhelming on the day – more on this later. Whether we look at the market from a points or percentage perspective, you were either in or out on Monday; there was no middle ground:

- Percentage swings: Liontown Resources (LTR) +11.4%, Block (XYZ) +11.2%, and AMP Ltd (AMP) +9.8% compared to Insignia (IFL) -5.8%, Pinnacle Investments (PNI) -5.3%, and Mesoblast (MSB) -4.2%.

- Point swings: Commonwealth Bank (CBA) -25.5 pts, Westpac (WBC) -14.1 pts, and National Australia Bank (NAB) -9.5 pts compared to BHP Group (BHP) +2.9 pts, Block (XYZ) +2.2 pts, and Woodside (WDS) +2.2 pts.

We’ve often been known to quote, with reference to the ASX, that “it can’t go up with the banks”, and Monday demonstrated the sector’s influence in no uncertain terms. Over the weekend, the financial press ran headlines around Warren Buffett selling down his bank holdings, which, combined with the sector trading on its richest valuation in history, driven higher by momentum traders, was enough to unleash a crescendo of selling as traders & investors scrambled to rebalance their portfolios or simply exit the banks. As we said in yesterday’s Match Out Report, “it’s not often you can buy BHP on less than half the multiple and twice the yield of CBA”.

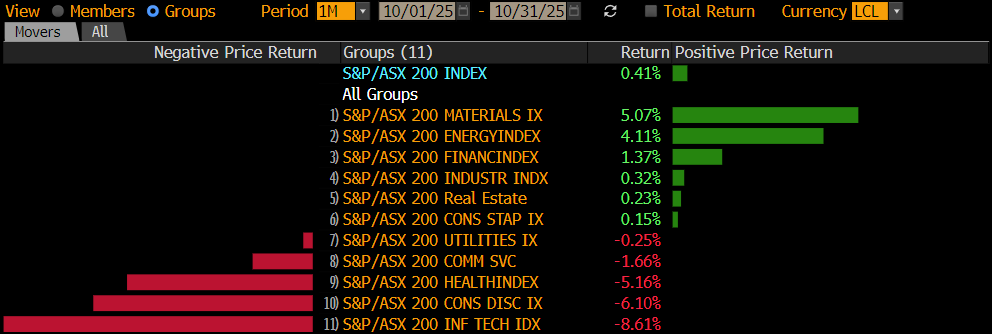

We are approaching the seasonally weakest two months of the year. Coincidentally, if the ASX200 closes under 8600 in the coming days/weeks, it will trigger a technical sell signal targeting the 8400 level. However, as we’ve discussed at length in recent weeks and witnessed yesterday, the market is not moving as one, with stock and sector rotation coming to the fore. If we do see further weakness in the coming weeks/months, we believe it’s likely to follow a similar path to Monday from a relative performance perspective.

Overseas markets were mixed overnight. In Europe, the EURO STOXX 50 slipped 0.3% while the UK FTSE gained +0.2%. In the US, the tech-based NASDAQ closed +0.5% higher while the small-cap Russell 2000 slipped 0.4%. The S&P 500 closed above 6300 for the first time, but the index surrendered almost 80% of its intraday gains late in the session.

- The SPI futures are calling the ASX200 to open up +0.1% this morning, reclaiming a small percentage of yesterday’s sharp sell-off – BHP advanced another 30c in the US.

The headlines over the weekend were full of Warren Buffett, through Berkshire Hathaway, selling down the banks. However, over the same period, he increased his exposure to the energy space, which interestingly managed to gain +1.2% on the ASX even though the broad market fell away on Monday.

- Buffett increased his position in Occidental Petroleum Corp (OXY US) by taking his holding to 28.3%, worth almost $US13bn.

- Buffett still holds a 6.8% stake in Chevron Corp (CVX US) worth almost $US20bn.

This morning, we briefly touched on the energy sector, deliberately avoiding the uranium and coal names, which have performed strongly of late and are largely covered across our portfolios.