- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

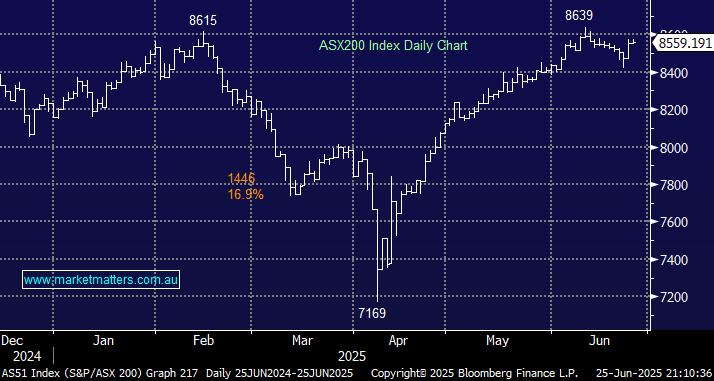

The ASX200 struggled to make any meaningful headway on Wednesday, even after the Dow closed up over 500 points and we received a particularly market-friendly inflation print:

- The monthly CPI came in softer than expected for May, with the headline inflation of +2.1% YoY well below both the expected +2.3% and the previous +2.4%.

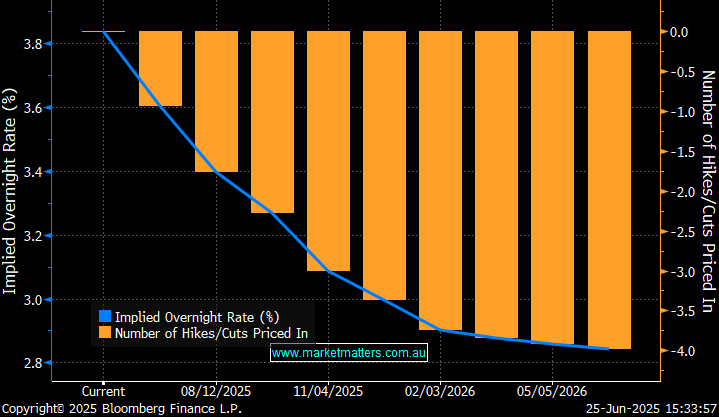

Credit markets are now pricing in a 94% chance the RBA will ease by 0.25% next month, plus at least two additional cuts before Christmas – theoretically, great news for rate-sensitive stocks and, of course, mortgage holders. However, while the financials, consumer discretionary, utilities and real estate sectors followed the script, all closed higher, the broader market struggled – 7 out of the market’s 11 main sectors retreated, along with over 50% of stocks on the main board. When we combine this progress on inflation with the recent decline in crude oil, the obstacles ahead for the RBA lie primarily with the potential impact of US tariffs.

- We’re with the crowd on this one, following yesterday’s CPI, looking for a rate cut in July and two more before Christmas.

We remain bullish on the ASX200 into Christmas, but as we’ve discussed in recent months, it’s likely to be a three-steps-forward, two-steps-back advance, with stock and sector rotation set to come increasingly to the fore. As we witnessed on Tuesday, for the local market to make meaningful gains, the banks and resources need to move together, a big call with CBA close to $200, and BHP struggling to regain investor confidence as iron ore stays anchored below $US100/MT.

Overseas markets were mixed overnight, with European bourses falling. The EURO STOXX 50 closed down 0.9%, and the UK FTSE 0.5%. In the US, the tech-based NASDAQ added to recent gains, closing up 0.2% while the small-cap Russell 2000 fell 1.2%. The $US dollar slipped, enabling gold, oil and copper to all make some headway.

- The SPI Futures are calling the ASX20 to open down 0.5% this morning, in line with the weaker performance by European markets.