- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

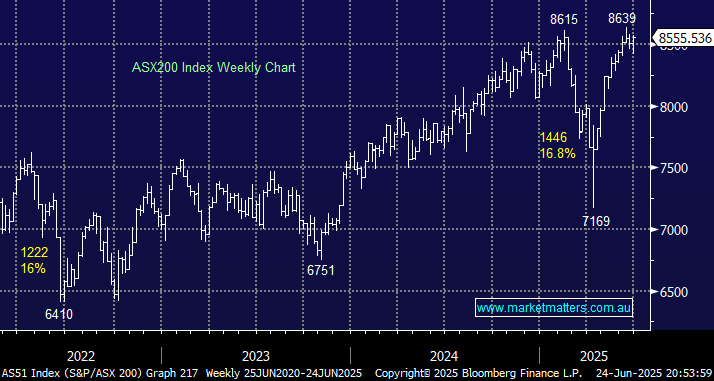

The ASX200 surged almost 1% on Tuesday, taking the index back within 1% of its all-time high. Optimism that the worst of the Middle East conflict is already behind us drove the market higher on broad-based buying, which came with a definite “risk on” twist. Outside of the energy sector and some defensive pockets, losses were contained, whereas a more than average 2% gain by the “Big Four” Banks and an even stronger session by heavyweight miners powered the local market to within one good day of posting a new all-time high.

- We maintain our bullish outlook through 2025, with the 8800-9000 area our “best guess” as a target area; a question we’re being asked with increasing regularity.

If the banks can remain firm, and the likes of BHP and RIO regain some of their mojo, we could end up being conservative with the mid-point of our target area only 4% away. The key is to remember that surprises often occur in the direction of the trend, which is bullish. Additionally, forecasting how far a market will extend when it breaks out into new highs is at best guesswork, but at MM, we remain comfortable staying long, and buying the dip if/when it emerges over coming months, which, from a seasonal perspective, is most likely to occur between August and September.

Another chapter of “Fear & Greed” will follow in the footsteps of the Middle East, assuming the conflict doesn’t escalate further. Tariffs are already feeling like old news, as are rising long-term bond yields, and if the Israel-Iran conflict goes the same way, the bears will be forced to ask what can stop this bull market? After enduring wave after wave of bad news, investors might have to decide how to play some good news for a change, with earnings holding up, global rate cuts expected into Christmas, Chinas economy is showing early signs of a recovery, plus, of course, the added bonus that fund managers and many retail investors are still underweight stocks.

Overseas markets were strong overnight, led by the US tech sector, which surged over +1.5%, testing its record high into the close. Wall Street bulls took solace from further easing of Middle East tensions and balanced comments from Fed Chair Jerome Powell on prospects for rate cuts. Treasury yields and the dollar fell while oil and gold continued to decline. In Europe, indices followed the US gains with the German DAX closing up +1.6% and the French CAC +1%,

- The ASX200 is set to open slightly higher this morning after yesterday’s powerhouse session with energy, gold, and defensive names likely to limit the index advance, while a $2.5bn capital raise by Xero (XRO) to fund a new acquisition may also sap some of the buying early on.