- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

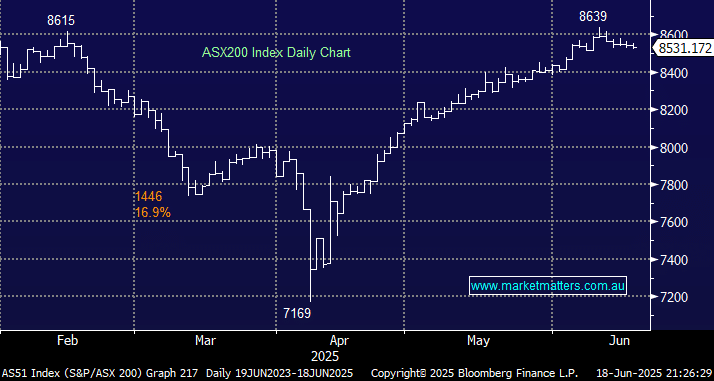

Wednesday saw the ASX200 close down 0.1% after rotating in another tight 0.4% range as the market remains in its “Middle East Conflict” holding pattern. The losers slightly beat the winners, with only two stocks moving by over 5%, illustrating the lacklustre nature of the day. At the sector level, weakness in the resources sector more than offset gains in tech, which we will examine later today. The Israel-Iran conflict has understandably raised risk premiums, which is why global equity markets have dipped. However, in our opinion, the 1.2% pullback by the ASX200 doesn’t feel sufficient considering what could unfold over the coming week(s).

- MM took some profits across several portfolio’s on Wednesday, believing safety was the better form of valour at current levels, reducing or selling some stocks at or near our targets – Alert.

While we still expect the local market to post fresh highs into Christmas, some volatility on the stock and sector levels into the end of the financial year could easily play out. Now, we have the added uncertainty surrounding the Iran-Israel conflict, plus, of course, whether the US will intervene. How this will be resolved feels like a three-dimensional game of chess between Netanyahu, Khamenei, and Trump, a game with numerous intriguing permutations. Having a little extra cash on the sidelines will afford us the flexibility to be proactive if the market takes any future news negatively, i.e. we can “buy the dip”.

- We are looking for a “3-step forward, 2-back” style of advance into Christmas with most value on offer through stock selection.

When we stand back and look at the current state of play, the ASX is trading on an Est PE of 19.2x, with consensus earnings growth of just 1.1% for FY26. The average PE over time is 15.7x . Australian GDP is running at 1.3% (relative to 2.4% 10-year average), inflation is 2.4%, back within target and the RBA cash rate is at 3.85%, enroute to ~3%.

While valuations are stretched at the index level relative to expected growth, we’d caution against using this as a reason to ‘get out’ of equities. Instead, we think it’s a reason to add a bit more flexibility to a portfolio, which seems to be the similar view to the world’s largest asset manager, Blackrock after the local markets’ sharp 20% recovery following April’s panic sell-off: they have cut their local exposure and European exposure in favour of emerging markets. We remain bullish on the local market, but stock selection is becoming increasingly important as we enter the second half.

- The SPI Futures are calling for the ASX200 to open down 0.3% this morning following a flat session on Wall Street and mixed comments from the Fed.

This morning, as we hear that the Middle consortium bidding for Santos (STO) wants all of the business as they look to tick one of Canberra’s obvious concerns, MM has looked at three other ‘situation plays’ now, or moving forward in the ASX200:

- Santos (STO) closed at $7.79 on Wednesday, well below the ~$8.90 bid as FIRB fears weigh on expectations that the deal will ultimately come to fruition.