- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

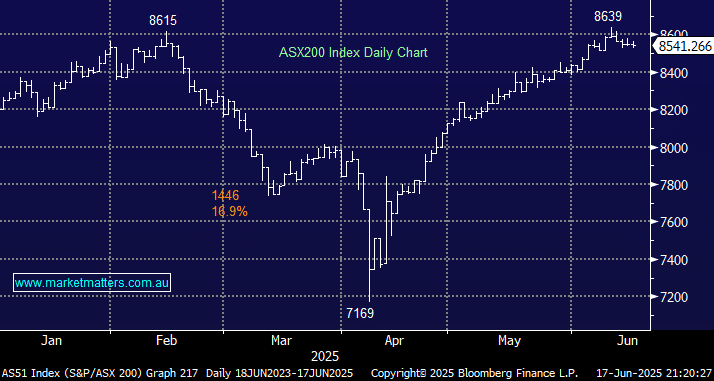

The ASX200 slipped 0.1% on Tuesday as uncertainty around the Middle East increased following some confusing and contradictory comments from President Trump et al, leading to a ~0.6% slide by the US S&P 500 futures, surrendering most of Monday’s advance in the process. Trump announced an early departure from the G7 leaders’ summit in Canada, just hours after he urged the evacuation of Iran’s capital, Tehran, on social media, suggesting something big is brewing, but whether it’s a negotiated resolution or something more extreme for its 6 million residents is hard to interpret.

- US President Donald Trump said his early departure from the Group of Seven leaders meeting in Canada has “nothing to do” with working on a ceasefire between Israel and Iran, instead saying his reason is “much bigger than that.”

Equities adopted a mild form of “if in doubt, get out” on Monday after the announced return by Trump to the White House as he played down the prospects of a ceasefire in favour of “a real end.” Let’s all hope and pray it comes with the minimal loss of life. From a market’s perspective, stocks dislike uncertainty, and if the conflict is resolved, they are likely to rally. However, the trio of Trump, Netanyahu, and Khamenei is balancing on a very narrow beam.

- Before gathering his advisers in the Situation Room, Trump posted a demand for Iran’s “UNCONDITIONAL SURRENDER” and warned of a possible strike against the country’s leader, Ayatollah Ali Khamenei – it feels like it’s going to get worse before it improves.

Considering the news flow, Tuesday was another quiet day with the ASX200 trading in a tight ~0.5% range. The winners & losers were exactly matched; it was the banks that dragged the index begrudgingly into negative territory. At the same time, the uranium, gold and lithium stocks all battled hard for the bulls as we continue to see plenty of stock rotation – no surprise in June

Overseas markets struggled overnight as Trump’s aggressive rhetoric gathered momentum. In Europe, the German DAX fell 1.1% while the UK FTSE held up better, retreating 0.5%. Losses were similar in the US, with the S&P 500 falling 0.8% and the tech-based NASDAQ 1%. A 4.5% surge in the oil price illustrates where the market’s attention is currently focused.

- The ASX200 is set to open down 0.2% this morning, with the energy sector again likely to offer the main support