- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

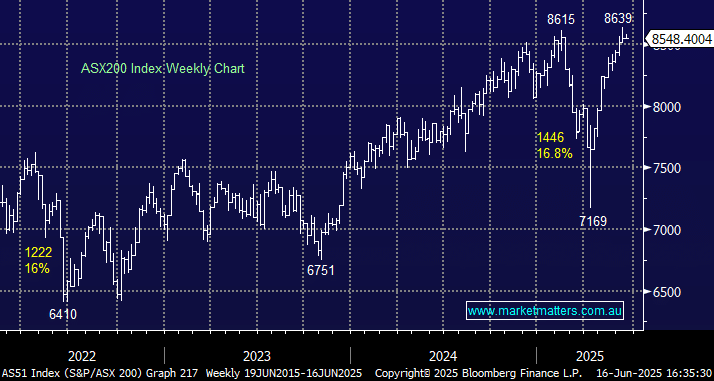

The ASX200 surprised many on Monday, managing to eke out a small gain even after the Dow tumbled over 760 points on Friday night, although it helped that US futures bounced ~0.5% during our trading session. It certainly hasn’t taken long for the Middle East conflict to join other recent geopolitical & macroeconomic events in being ignored by stocks, as fears of missing out on further strength remain a greater concern to many fund managers. The week started with winners and losers equally matched, with the energy stocks offsetting a rare negative day for the “Big Four Banks”. More on the big winners later in this report, but needless to say, the stars aligned after Santos (STO) received a takeover bid from UAE giant ADNOC at $US5.76, or around $8.90 and Middle East tensions drove oil higher, while uranium stocks trumped them all.

The gold stocks were the market’s weakest link as they lost their defensive status in the blink of an eye. Stocks often lead corrections in the precious metal, and with gold trading only ~2% from its all-time high and Evolution (EVN) more than 13% below this month’s high, the phenomenon looks set to be repeated. We see gold stocks adding to yesterday’s weakness. Still, we are looking to increase our exposure to the sector into a deeper pullback, implying we would not be a buyer at current levels – remember we’ve said a few times of late that gold is a crowded trade that’s vulnerable to a washout style correction:

- Northern Star (NST) -8.2%, Evolution (EVN) -8%, Westgold Resources (WGX) -7.6%, Ramelius (RMS) -7.5%, Regis Resources (RRL) -3.8%, and Emerald Resources (EMR) -2.8% – further declines are likely this morning.

Mixed economic data from China showed better-than-expected but ultimately subsidised retail sales in May, while 23 months of consecutive falls in new home prices showed the clouds continue to loom large over China’s depressed property market. However, Chinese stocks took the data in their stride, with the Hang Seng China Enterprise Index trading up +0.86%, while the Korean Kospi and Japanese Nikkei were the brightest stars in the region as the buyers returned in earnest.

Overseas markets were firm, helped by an announcement from President Trump that Iran wants to talk, which diminished fears of an all-out Middle East War. In Europe, the German DAX advanced by +0.8% while the UK FTSE gained by +0.3%. US stocks opened strongly and advanced steadily throughout the session, with the tech-based NASDAQ closing up 1.4%, while the broad-based S&P 500 closed 0.9% higher.

- The SPI futures are calling the ASX200 to open slightly higher this morning, with tech and financial stocks likely to be firm.