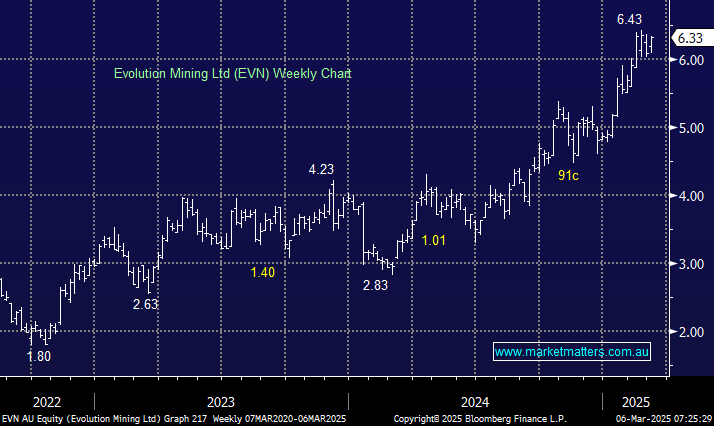

EVN is not a traditional Cu play per se, but around 30% of its revenue will comes from industrial metal, so it shouldn’t be ignored. In a similar fashion to SFR, it should be recognised that the stock has also experienced three significant pullbacks in the last few years, and while we like Cu and Gold in the medium term, a spike higher in the miner may provide a selling opportunity with a view to re-entering into a pullback – but we note as fans of EVN as a business it needs to be a sharp move higher for us to consider this move.

- We will reconsider our EVN position ~$7. MM holds EVN in its Active Growth Portfolio.